In business for more than 100 years, Southern Company (SO) is a major regulated utility involved in selling electricity and distributing natural gas, primarily across the Southeastern U.S. The firm’s vertically integrated electric utilities serve customers across Georgia, Alabama, Florida, and Mississippi.

Southern Company’s mix of business and service territories significantly changed after the company’s 2016 acquisition of natural gas utility AGL Resources for $12 billion. AGL Resources owns more than 80,000 miles of pipelines and over a dozen storage facilities it uses to transport and distribute natural gas to businesses and households across Illinois, Georgia, Virginia, New Jersey, Florida, Tennessee, and Maryland.

After acquiring AGL Resources, Southern Company’s customer count roughly doubled to 9 million, and its energy mix shifted from 100% electric to a 50/50 mix of electric and gas. The utility services a diversified blend of residential, commercial, industrial, and wholesale customers.

Approximately 95% of the company’s earnings are funded by state-regulated utilities and businesses with long-term contract models, providing predictable cash flow. Southern’s power sources are diversified, but it depends the most on natural gas, coal, and nuclear.

Business Analysis

Utility companies spend billions of dollars to build power plants, transmission lines, and distribution networks to supply customers with power. Given their economies of scale, it usually isn’t economical to have more than one utility supplier in most regions because the base of customers is only so big relative to the investments required to provide them with electricity and gas.

These capital-intensive businesses must also comply with strict regulatory and environmental standards, and state utility commissions further reduce competition since they have varying degrees of power over the companies allowed to construct generating facilities in various service territories.

In other words, most utility companies are essentially government regulated monopolies in the regions they operate in. However, the monopoly status of most regulated utilities has a major downside – the price they can charge for their services is controlled by state commissions.

The government controls the rates that regulated utilities can charge customers to ensure they are fair while still allowing the utility company to earn a reasonable return on their investments to continue providing quality service.

Each state’s regulatory body is different from the next, and some regions have been better to utilities than others. The Southeast region has historically been friendly to businesses, and Southern Company’s electric utilities operate in four of the top eight most constructive state regulatory environments in the U.S. according to RRA:

Southern also maintains strong relationships with regulators in part due to its reputation and the reasonable rates it currently charges, which are below the national average and perceived as being more customer-friendly. As a result, Southern’s traditional electric operating companies have enjoyed an average return on equity over 12% during the last five years, which is above the level that most utilities earn.

The South is also one of the fastest-growing regions in the country, which makes Southern Company a relatively more attractive utility than many others, all else equal. In fact, according to the National Real Estate Investor, “the Southeast region would form the sixth largest country in the world with a growth rate that would exceed any in the top five.”

Southern Company has historically enjoyed annual customer growth near 1% in its electric and gas businesses. However, retail electric sales growth is still only projected to be flat to slightly positive going forward. Despite continued population and job growth in the region, increasing energy efficiency continues reducing the amount of electricity that needs to be consumed.

As a result, Southern’s earnings were growing by about 3% per year over most of the past decade. In late 2015, management announced plans to acquire AGL Resources for $12 billion. AGL is one of the largest natural gas distribution operators in the U.S., serving 4.6 million customers in seven states and generating over 70% of its earnings from regulated operations.

Most of AGL’s rates are set through cost-based regulatory mechanisms, including base rate cases and infrastructure investment programs. The business is expected to continue delivering healthy returns on equity of approximately 10% over the long term, providing another important yet predictable stream of cash flow for Southern Company.

Owning AGL Resources opened up a new array of growth projects for the company to invest in as well. Advancements in natural gas drilling techniques have resulted in historically high and growing supplies of natural gas and relatively low gas prices in the U.S. Not surprisingly, this business is enjoying much faster growth rates than Southern’s electric utility operations.

As a result, this merger was expected to boost Southern Company’s long-term earnings growth rate by a full percentage point to 4% to 5% annually. Importantly, this deal about doubled the company’s customer base, shifted about half of its customer mix into natural gas, provided some regulatory diversification (operations expanded into new states), and somewhat reduced the impact from Southern’s large construction projects that have been delayed (more on that later).

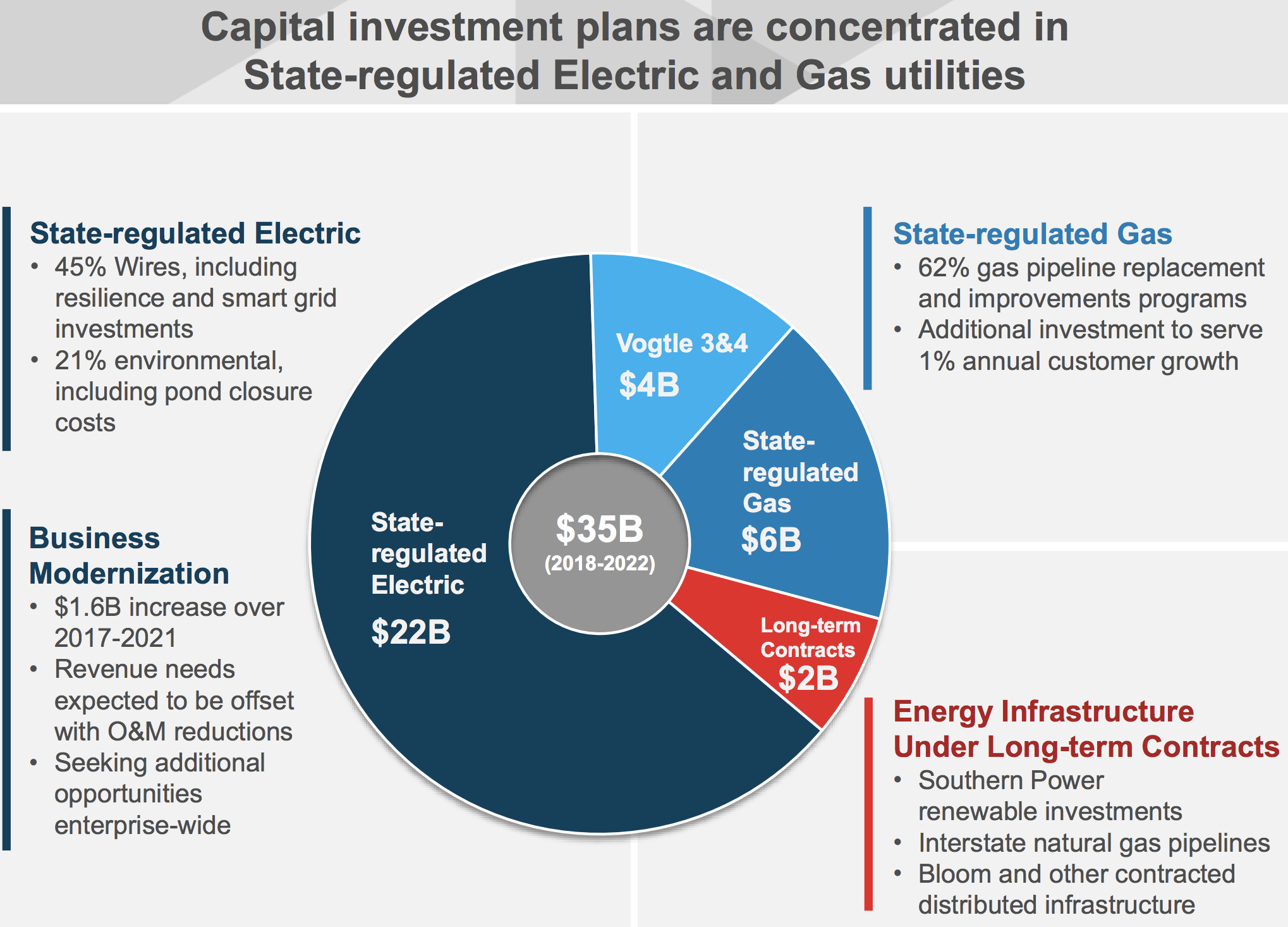

Going forward, Southern Company has plans to invest $35 billion between 2018 and 2022, with the bulk of its money going into state-regulated electric (4% invested capital growth) and gas (9% invested capital growth) utilities.

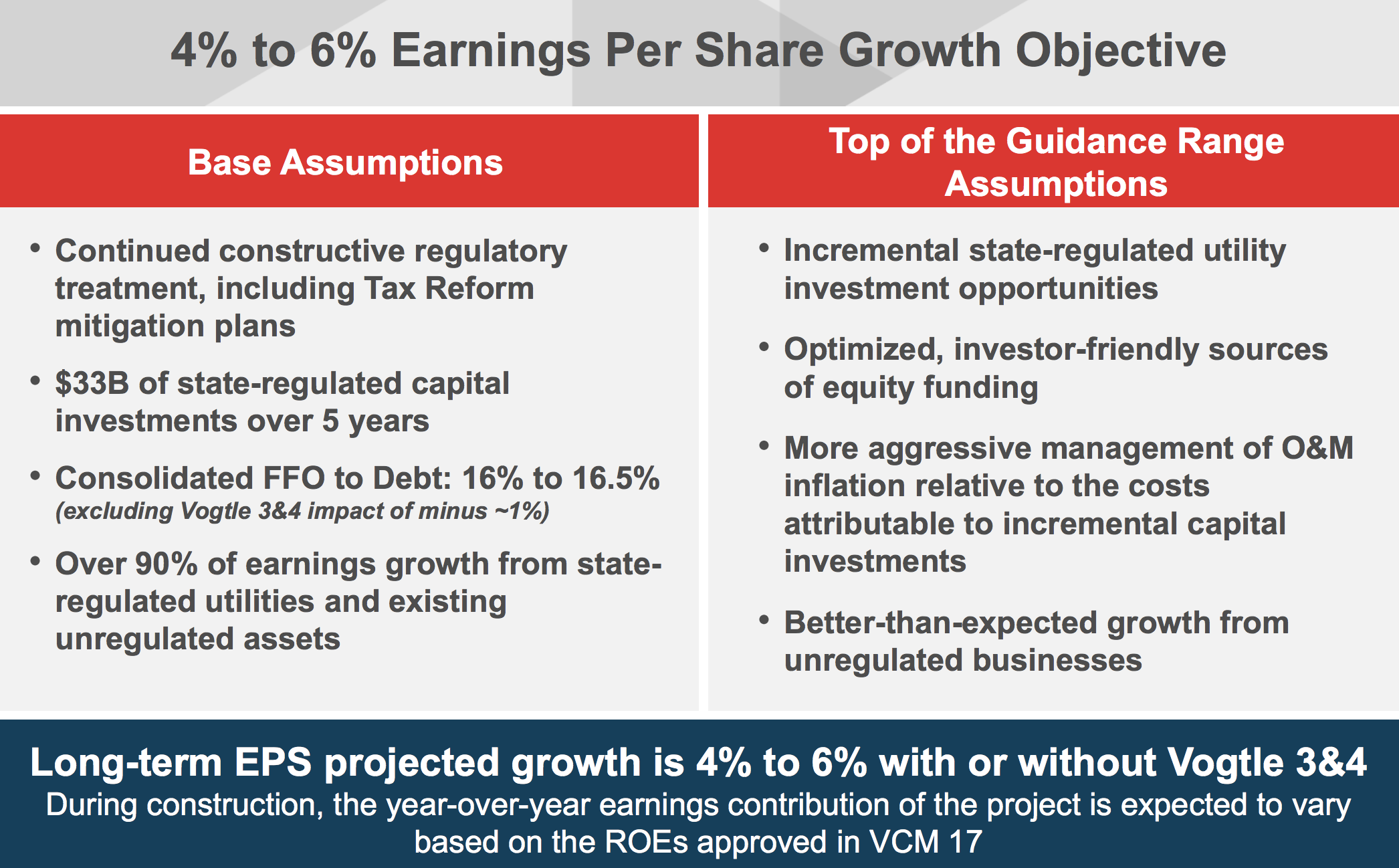

As a result, management expects Southern Company to generate 4% to 6% annual earnings per share growth (with or without its troubled Vogtle nuclear projects). Continued deleveraging and regular dividend growth is expected as well.

Finally, it’s worth mentioning that Southern Company is the only electric utility in the country that is committed to a portfolio of nuclear, coal gasification, natural gas, solar, wind, and biomass. The company plans to invest up to $1.5 billion annually in growth projects to continue developing its portfolio of long-term contracted assets in wind, solar, natural gas, and biomass.

The company’s mix of resources is expected to become more diversified over the years ahead. Its use of coal has already fallen from 66% of generating capacity to 36% in 2015 and is expected to be below 30% by 2020. A diverse generation fleet reduces the company’s risk of being overly dependent on any one source of energy.

Overall, there are several key reasons why Southern Company has been able to reliably reward income investors with uninterrupted dividends since 1948. Most importantly, the business operates in regions with generally favorable customer demographics and has maintains constructive relationships with regulators.

With almost all of its earnings derived from regulated activities and businesses operating under long-term contracts, Southern Company should be able to continue investing in profitable and predictable projects to continue expanding its reach over time. That’s especially true thanks to its meaningful presence in natural gas distribution and renewables.

Key Risks

Despite its impressive track record, Southern Company has fallen on hard times in recent years that have caused significant financial strain and even led some dividend investors to question the safety of its payout.

The company’s biggest challenges have stemmed from the multibillion-dollar cost overruns and years of delays it has experienced while working on its coal-gasification plant in Mississippi (Kemper) and two nuclear reactors in Georgia (Vogtle).

When projects run over budget, regulated utilities are largely at the mercy of state regulators to recoup their additional costs from retail customers in the form of higher rates. If regulators are unwilling to play ball, the utility company’s shareholders can be on the hook for its cost overruns, potentially jeopardizing its dividend if the situation is severe enough.

Kemper was initially expected to cost less than $3 billion and go into service in 2014, but its price tag eventually ballooned to approximately $7.5 billion. The plant’s construction time was also delayed by more than four years, and Southern Company ultimately had to scrap its clean coal plans, running the plant using natural gas instead. Not surprisingly, Kemper ended up being the most expensive natural gas plant ever constructed.

Regulators ruled not to allow Southern Company to recover its higher costs from electricity customers and demanded lower rates (customers’ rates had jumped 15% in 2015 due to the project). Southern’s shareholders had to eat a loss of more than $6 billion (for comparison, Southern’s net income averaged $2.5 billion in 2016 and 2015), but fortunately the rate recovery issue is now behind the company.

Southern Company faced even bigger challenges from its Plant Vogtle Units 3 and 4, two nuclear reactors it is building that are now more than $10 billion over budget and five years late (the plant was supposed to cost $14 billion in 2008).

Despite the major setbacks, in December 2017 Georgia’s public utility commission voted to allow Southern Company to continue building its nuclear reactors and deemed the company’s revised capital cost forecast and delivery schedule to be reasonable.

The commission did place more restrictions on how profitable the project can be for Southern by stepping down its allowed return on equity rates in the years ahead, reducing future returns by about $750 million, according to The Wall Street Journal.

Should the nuclear reactors not be commercially operational by June 2021/2022, the return on equity Southern is allowed be reduced by 10 basis points each month until each unit is operational. However, the return on equity can not go lower than Southern’s subsidiary’s cost of long-term debt, once again mitigating the company’s risk.

Simply put, the ruling takes a lot of uncertainty and risk off the table for Southern Company. In fact, in early 2017, the nuclear project’s future was especially in doubt after Westinghouse Electric, Toshiba’s nuclear services business and the leading contractor on Vogtle, declared bankruptcy due to rising costs.

Southern Company was very fortunate that Georgia Commissioner Chuck Easton is a proponent of nuclear power. According to The Wall Street Journal, Mr. Eaton said he hopes Vogtle will generate electricity for 60 to 80 years, and that it was unclear what would happen to natural-gas prices over that time span. He said he believes that nuclear “still needs to be part of a diversified mix.”

Reduced profits from the project is a far better outcome than having to shelve the partially-constructed reactors and potentially put shareholders on the hook for the billions of dollars of costs that had already been incurred.

Looking ahead, Southern Company expects Plant Vogtle Units 3 and 4 to be placed in service by November 2021 and November 2022, respectively. Less than $4 billion in costs are estimated to be needed to complete the project, and a new primary contractor, Bechtel, is working under a schedule that is about 8 months in advance of the targeted November 2021/2022 delivery dates.

Vogtle 3&4 earnings represent less than 6% of Southern Company’s projected earnings per share from 2018 to 2022, but it’s still very important that the company deliver for good this time on its budgeted cost and timeline.

With that said, the company still faces some financial risks. As a result of its cost overruns and $12 billion acquisition of AGL Resources, Southern’s debt has about doubled since 2015 to sit near $50 billion. Between $3 billion and $4 billion of debt matures each year through 2020 and either needs to be refinanced or paid down.

To make matters worse, U.S. tax reform is somewhat harmful to most regulated utilities. Their lower tax rate must be passed on to customers in the form of lower rates (resulting in less regulated revenue). The elimination of bonus depreciation and limitations placed on net operating losses (NOL) are expected to further reduce operating cash flows and, thus, put some pressure on debt ratios.

As a result of these factors (and Southern’s high payout ratio near 80%, which leaves little cash retained for the business), Southern Company has been raising money in several different ways. The company recently sold two natural gas distributors for $1.4 billion and plans to sell about 33% of its solar generation business, for example.

Management also forecasts an average annual equity need of $1.4 billion over the next five years. Around 80% of the equity capital raised is expected to be invested directly into Southern Company’s state-regulated electric and gas utilities to support stronger debt-to-equity ratios and reduce leverage. A smaller chunk will be used to fund increased capital investments such as Vogtle Units 3 and 4.

Essentially, management is trying to improve the company’s financial health in the most shareholder-friendly way possible while maintaining Southern’s ability to meet its long-term earnings growth guidance, finish its nuclear projects, and continue paying and growing its high dividend.

On that front, Southern Company’s payout ratio is likely to be in the 80% range for a period of time over the next five years, which is on the higher side for utilities. Once Vogtle goes into service, Southern expects its payout ratio to drop back into the 70% range. Assuming management executes on the company’s growth projects and is able to raise equity as expected, the dividend should remain safe.

Management also remains confident that the company can continue rewarding shareholders with regular annual dividend increases totaling eight cents, representing around 3% annual growth. With over $6 billion of available liquidity and plans in place to put the business on more solid financial ground over the next five years, Southern Company appears to be taking the right steps to return to delivering the safety and predictability investors have come to expect from it over the decades.

Closing Thoughts on Southern Company

Southern Company is a favorite holding in retirement portfolios due to its defensive nature and track record of paying uninterrupted dividends for more than 70 consecutive years, including over 15 straight years of higher payouts.The last decade brought with it a number of major project execution missteps, ringing up billions of dollars in cost overruns and casting some doubts over the company’s financial health in recent years.

Fortunately, much progress was made in 2017, and the worst appears to be behind the company from a regulatory risk perspective. However, Southern’s relatively high payout ratio is still a reminder that the company does not have a large margin for error in the years ahead. To continue improving its dividend safety profile, management needs to successfully execute on its growth projects (especially Vogtle) and capital-raising plans.

To learn more about Southern’s dividend safety and growth profile, please click here.

Leave A Comment