Founded in 1898, International Paper (IP) is the world’s largest global paper and packaging company with a No. 1 position in all of its key markets, which span North America, Europe, Latin America, North Africa, India, and Russia. The company owns over 290 facilities and has a total capacity of more than 20 million tons of paper and paper products per year.

International Paper operates through three segments:

- Industrial Packaging (69% of 2017 revenue): manufactures containerboards, which are the linerboards that primarily get used in packaging products such as cardboard boxes.

- Printing Papers (19% of 2017 revenue): produces printing and writing papers, such as uncoated papers for end use applications, including brochures, pamphlets, greeting cards, books, annual reports, and direct mail, as well as envelopes, tablets, business forms, and file folders.

- Global Cellulose Fibers (12% of 2017 revenue): provides fluff, market, and specialty pulps that are used in diapers, tissue, and other personal hygiene products that promote health and wellness.

The company sells its products directly to end users and converters, as well as through agents, resellers, and paper distributors. While International Paper is a globally diversified company, about 84% of its adjusted EBITDA is generated in the U.S. Its other markets include Brazil (8%), EMEA (5%), and Russia (3%).

Business Analysis

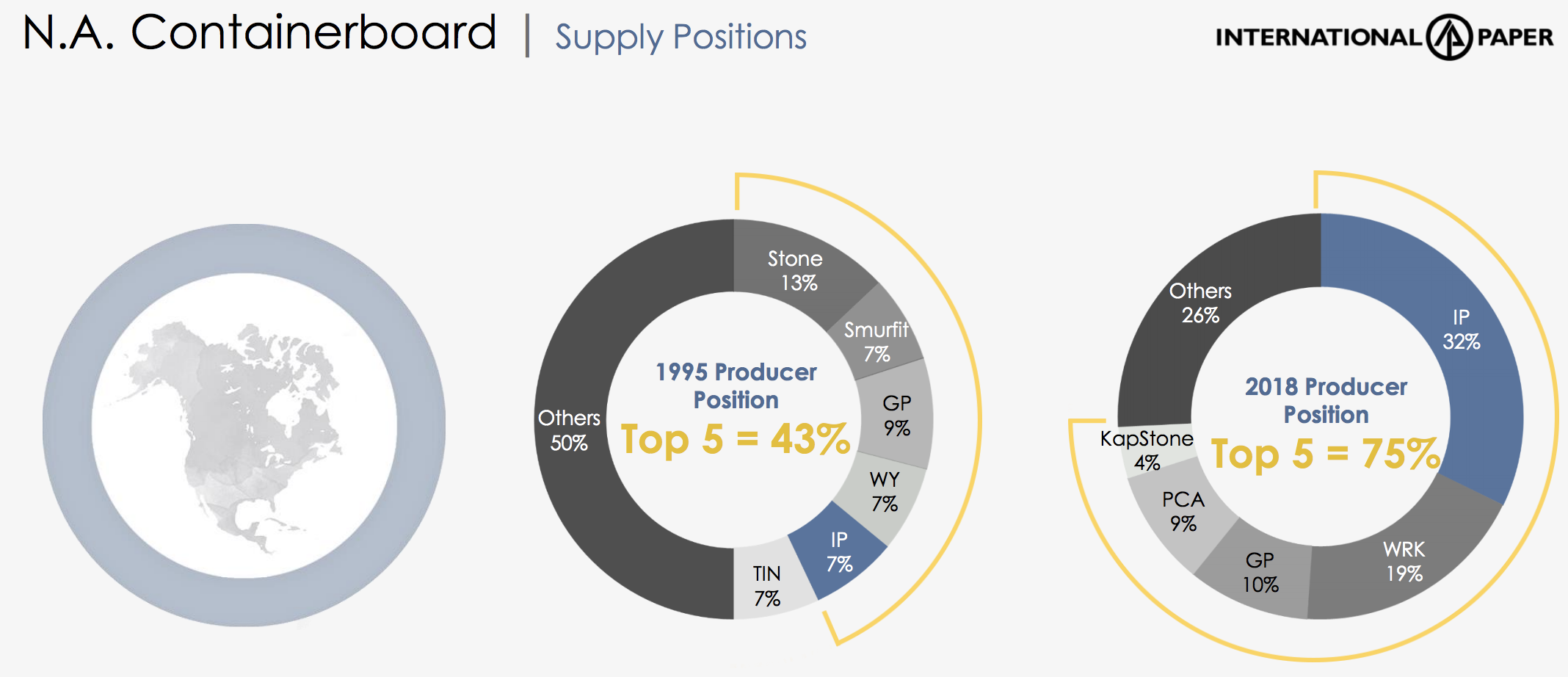

The paper products industry is large but highly fragmented, which has allowed International Paper to consolidate some of its smaller rivals over the years. This is especially true in the corrugated packages segment (boxes), which are an important input for the fast growing e-commerce market.

Today the U.S. containerboard market is dominated by just five major players of which International Paper is by far the largest. This has given International Paper cost advantages (99.8% of its linerboard production capacity is in the first quartile on the global cost curve), while increased consolidation has helped the industry’s operating rates and pricing discipline over the last several years.

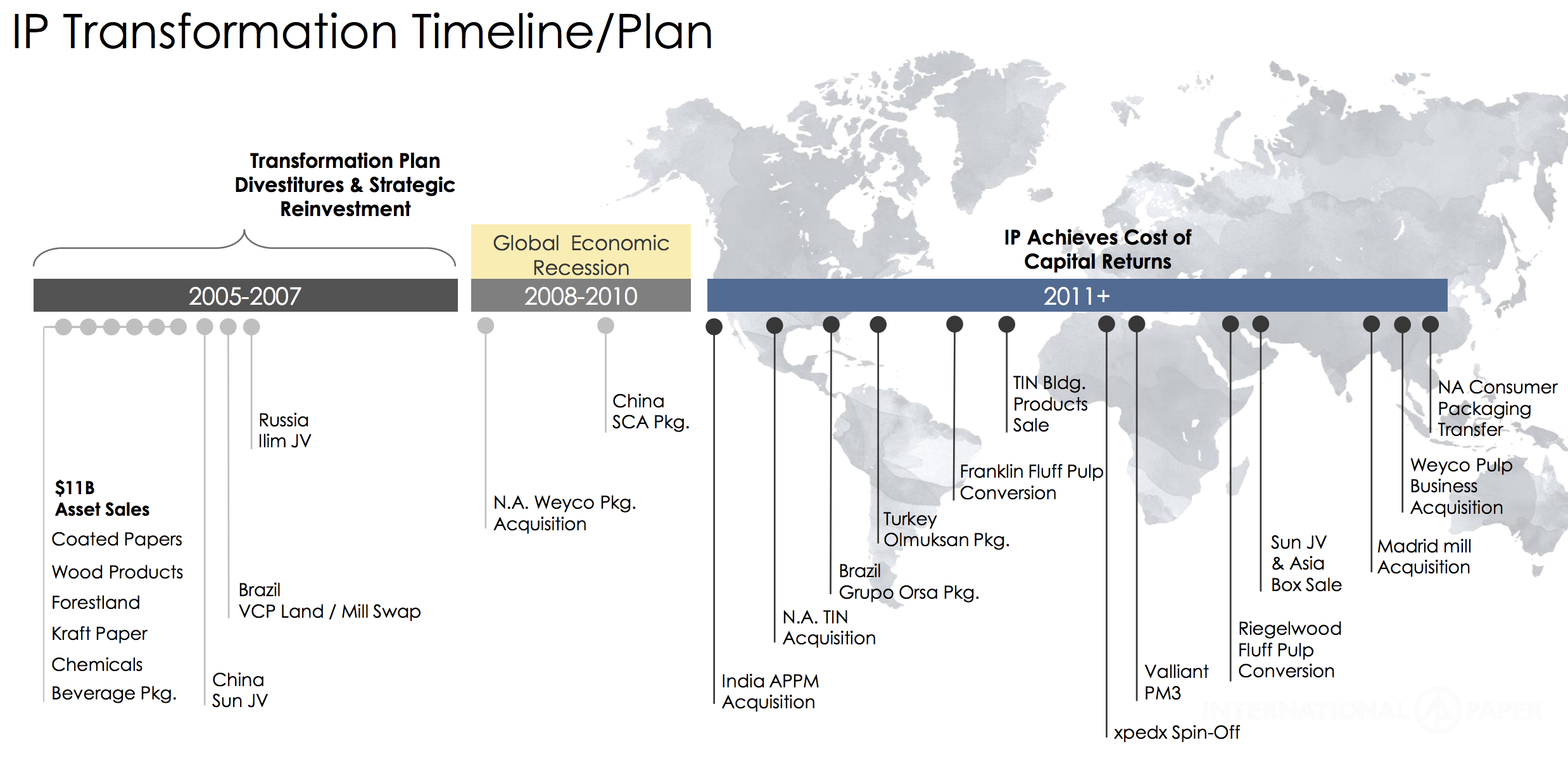

Another strategy International Paper has taken to improve its competitive positioning is gradually shifting its business model away from declining paper products and towards higher-margin packaging. This corporate restructuring involved about $11 billion in assets sales between 2005 and 2007.

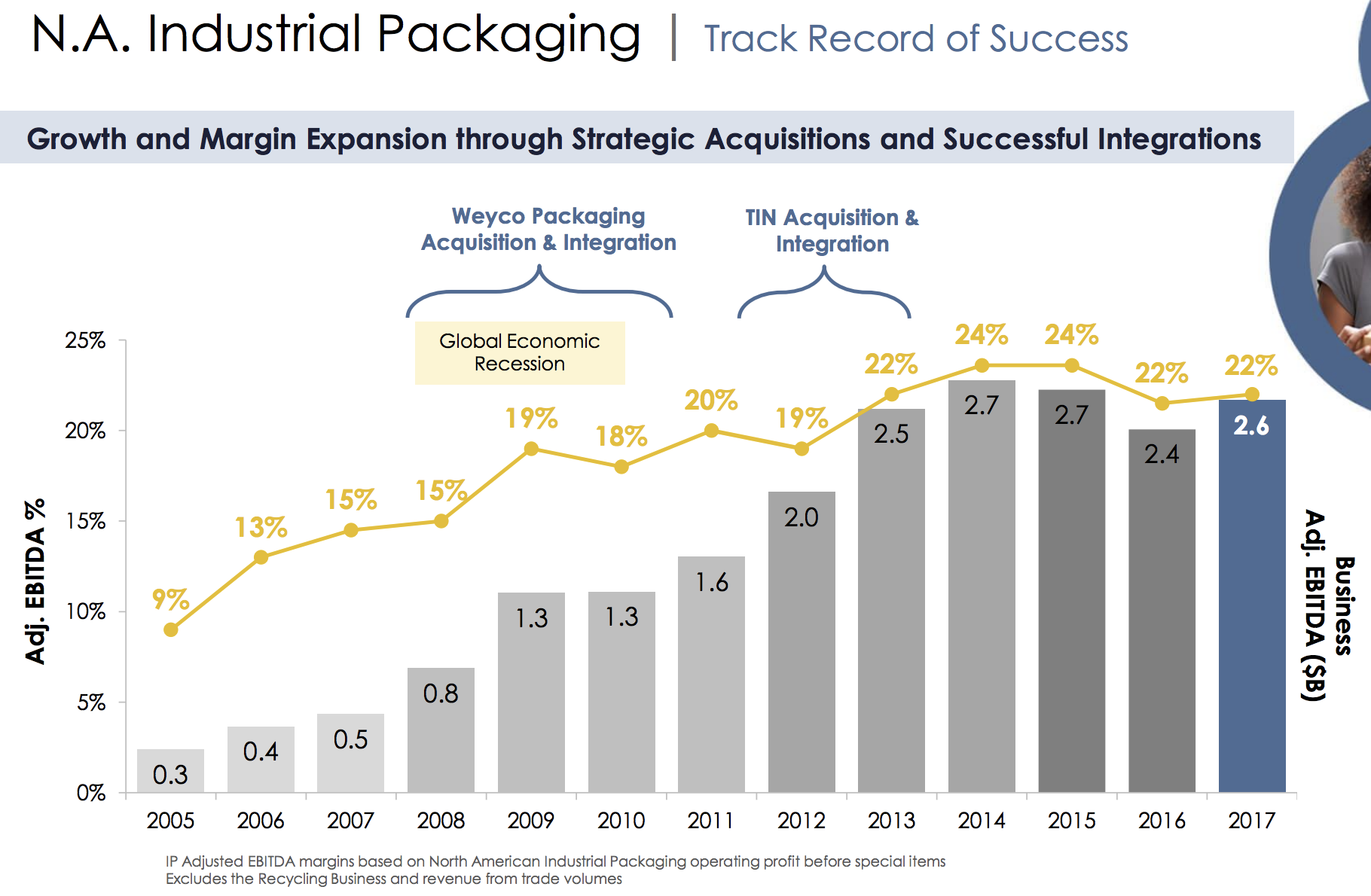

In recent years, the company has made aggressive acquisitions of box manufacturing assets and pulp businesses, which have higher margins than regular paper and increase the firm’s scale. For example, in 2011 International Paper acquired corrugated packaging company Temple inland for $3.7 billion, greatly expanding its packaged good segment and achieving $100 million in cost synergies along the way.

Management’s strategy has helped International Paper generate structurally higher profitability and more stable free cash flow over time, even during recessions.

To continue improving its profitability, International Paper has been converting some of its paper mills into linerboard facilities (that make boxes). This is why today nearly 70% of the company’s sales comes from selling higher-margin boxes.

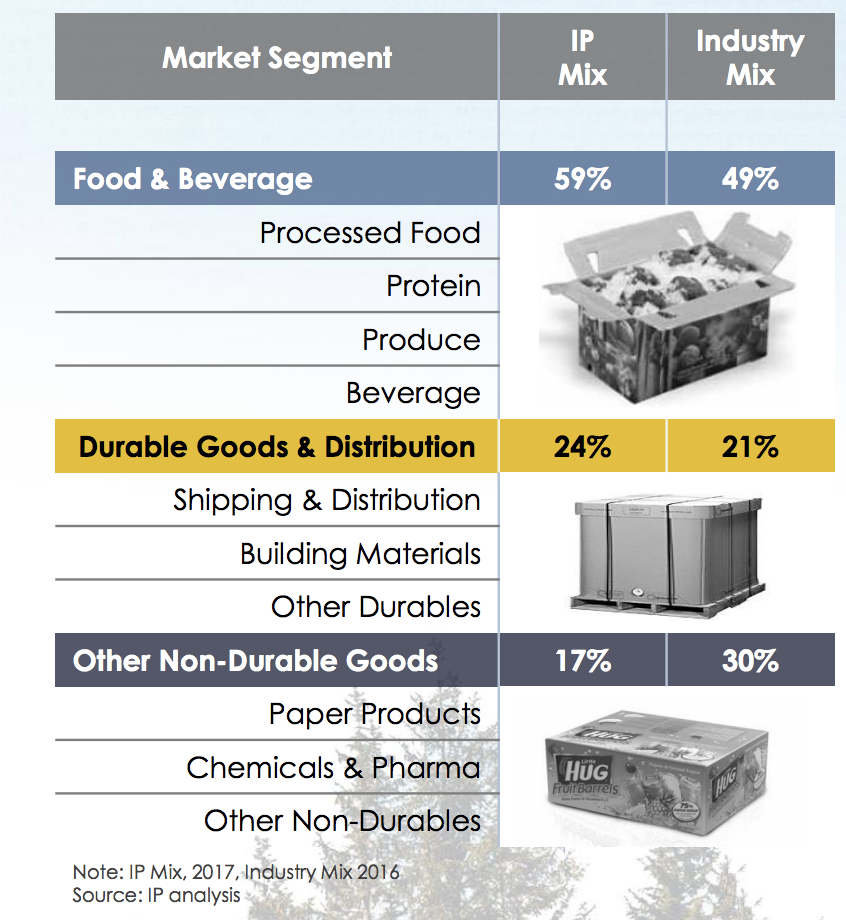

While these are a commodity product, demand for boxes is slowly but steadily growing thanks to stable shipment trends in core markets such as food manufacturing, as well as strong increases in online sales of goods that now need to be shipped.

And thanks to International Paper’s large economies of scale, as well as its shift away from paper to boxes, International Paper enjoys above average profitability with a net margin near 10%, about double the industry average. Despite the company’s improved profitability over the past decade, International Paper’s debt burden has also increased to finance its large acquisitions, including its 2016 purchase of Weyerhaeuser’s (WY) pulp business for $2.2 billion.

As a result, much of the company’s cash flow will need to go towards paying down the firm’s high debt levels over the next few years to help International Paper maintain its BBB investment grade credit rating from Standard & Poor’s.

The company’s dividend should continue to enjoy moderate growth given management’s long-term plans calling for maintaining a 40% to 50% free cash flow payout ratio.

In terms of growth, management plans to continue acquiring new pulp assets (the highest margin part of the business). The company also intends to continue consolidating paper mills and converting them to higher-margin linerboard. In fact, International Paper is investing $300 million to convert its Riverdale paper mill into a linerboard factory. This project is expected to be completed by mid-2019.

Finally, opportunistic share buybacks with remaining free cash flow (after paying dividends) are expected to help boost EPS growth. Overall, International Paper seems likely to continue growing its bottom line and dividend at a low to mid-single-digit rate over the long term.

However, investors have several reasons to be skeptical of whether or not International Paper can be a good long-term income growth investments. That’s thanks to numerous risks its industry faces in the coming years.

Key Risks

First, it needs to be pointed out that International Paper is in a slow-growing industry, one that is somewhat sensitive to the U.S. economy and can occasionally result in volatile sales and cash flow any given year.

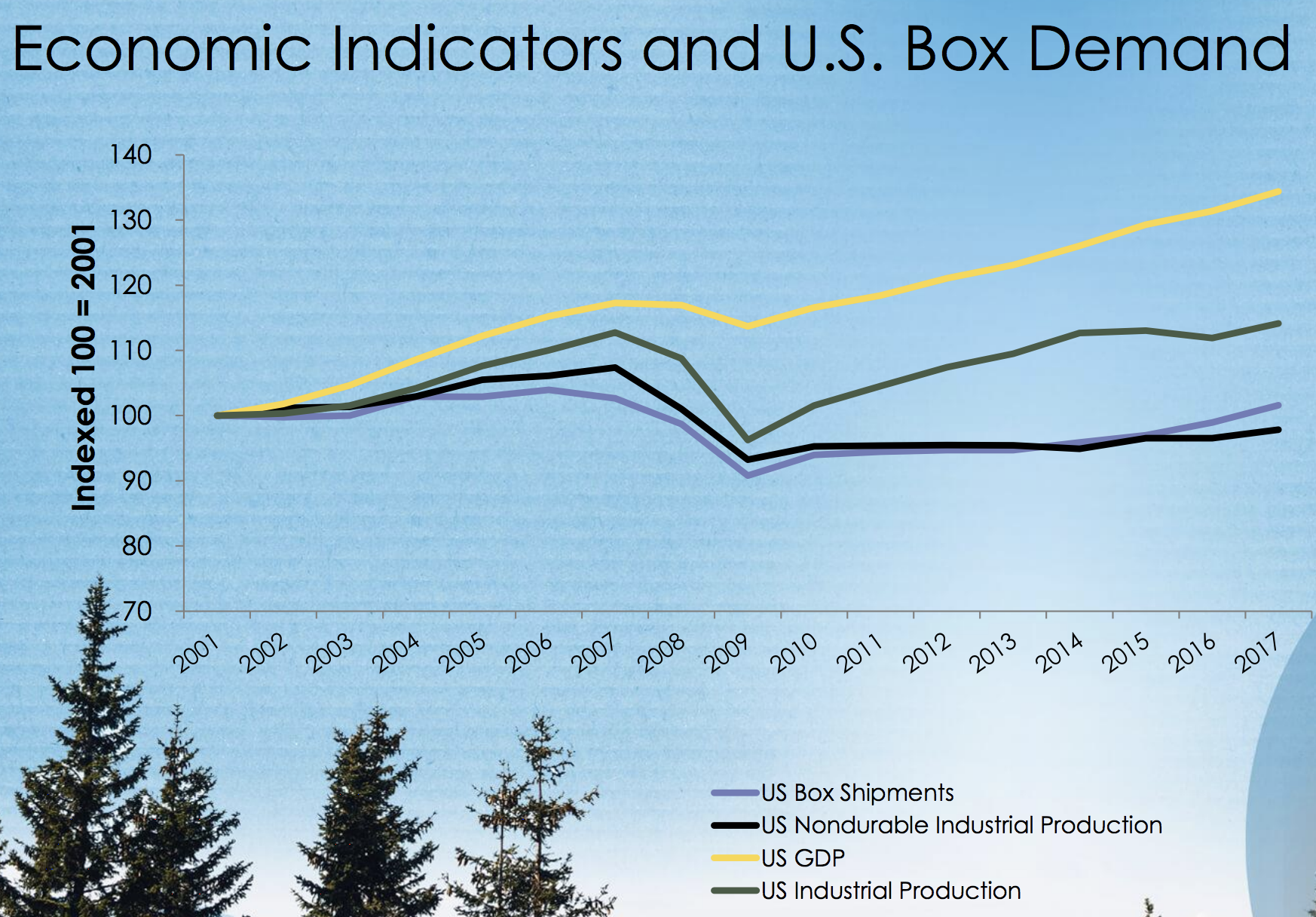

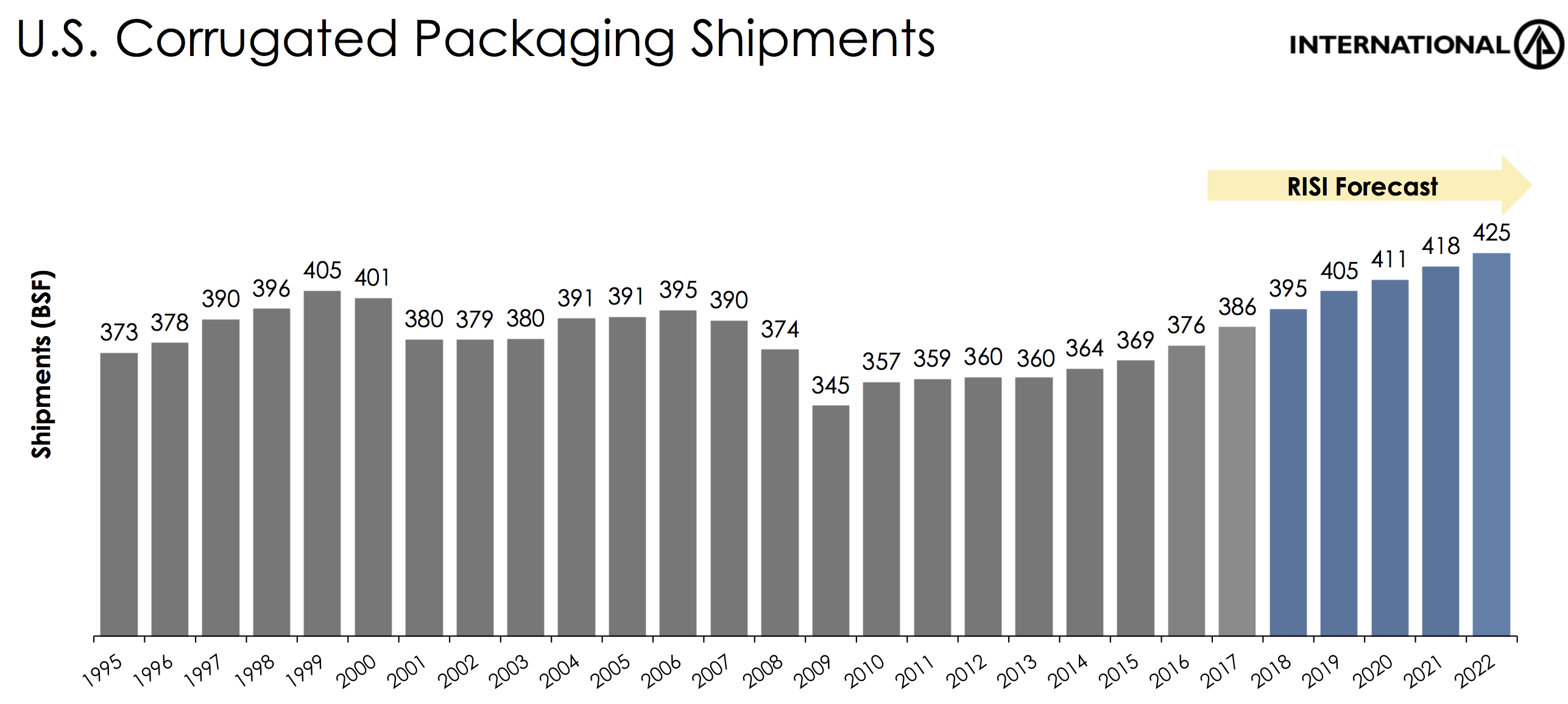

The company’s packaging business should enjoy a long-term boost from rising online sales, which increases the need for boxes to transport e-commerce goods. However, as you can see, box demand has not kept up with overall GDP growth or e-commerce growth. In fact, over the past 20 years U.S. box shipments have remained essentially flat.

Now analyst firm RISI does expect box volumes to increase in the coming years, though it is expected to take until 2020 before volumes surpass the all-time high set in 1999.

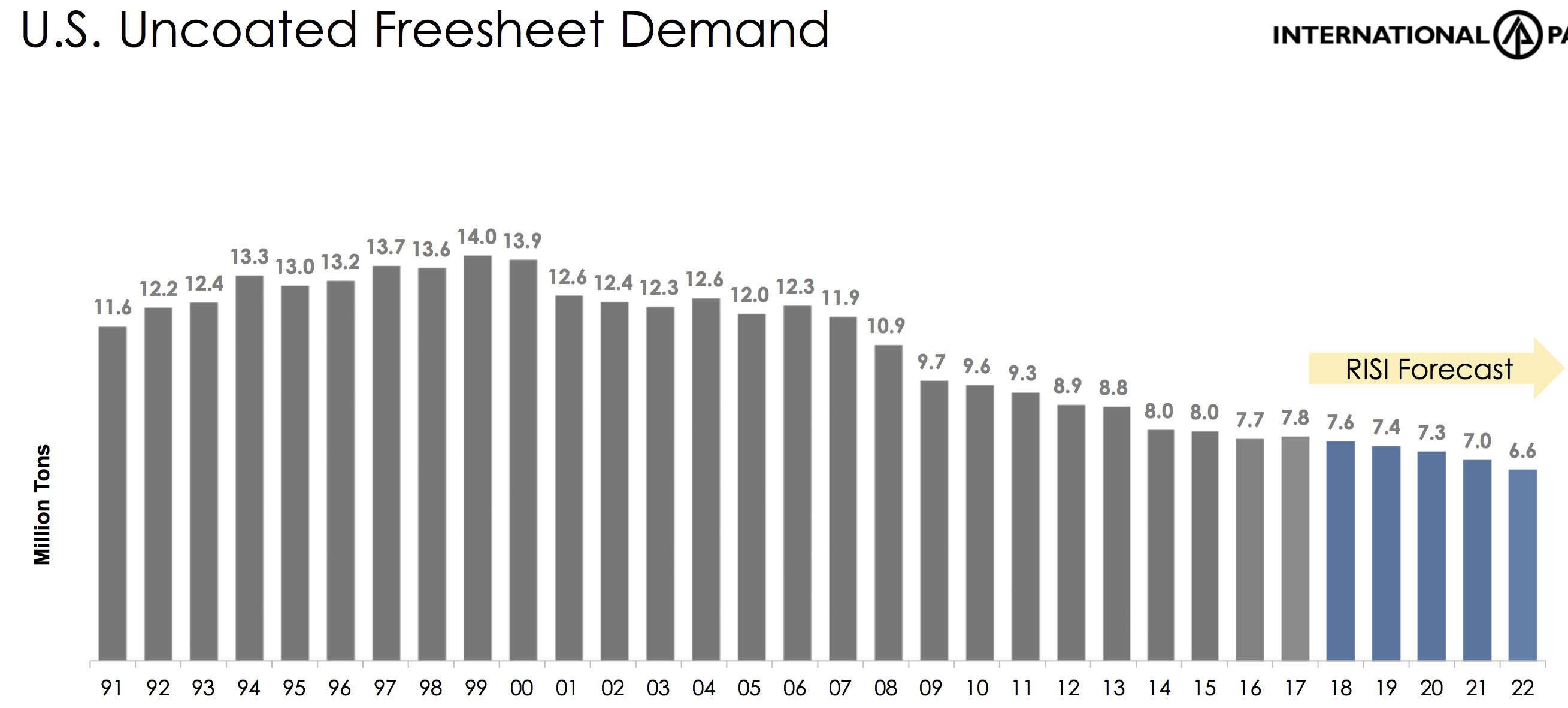

However, International Paper’s paper division (19% of 2017 revenue) is likely to face increasing headwinds that will weigh on the company’s overall growth as the world increasingly shifts away from physical paper. For example, analysts expected demand for paper in developed markets to decline by about 5% annually in the coming years, continuing a two-decade-long trend of falling paper volumes.

In emerging markets, growth is expected to remain essentially flat due to companies skipping paper and going straight to digital record keeping. Meanwhile, while online sales have been booming, the actual volume of boxes has only grown by about 1% per year according to Morningstar, a trend that is expected to continue for the foreseeable future.

In fact, International Paper’s revenue growth is expected to remain essentially zero over the next five years. Meanwhile, margin growth, boosted by recent acquisitions of more profitable products and paper to linerboard conversions, are expected to remain flat as well. In other words, the company won’t be able to easily grow its free cash flow except through cost cutting, which might not be so easily accomplished given its already lean operations.

International Paper could face some challenges on the margin front as well. Specifically, the firm has plucked most of the low-hanging fruit in terms of boosting profitability by divesting low-returning operations and converting paper mills into linerboard production facilities.

Industry consolidation has driven up capacity utilization to peak levels near 100%, but now there is incentive for more supply to enter the market that could result in falling pricing power and narrower margins in the future.

Besides short-term shifts in the industry’s supply and demand balance, which drive corrugated packaging pricing, International Paper can also be impacted any given quarter by foreign currency exchange rate fluctuations and commodity price volatility for key inputs such as pulpwood and old corrugated containers. However, these issues are unlikely to materially affect International Paper’s long-term earnings power.

Finally, investors need to recognize the risks that stem from International Paper’s elevated debt load and acquisitive growth strategy. Management plans to strengthen the company’s balance sheet in the coming years by paying down debt, so it is especially important the that U.S. economy and containerboard industry remain healthy. As acquisitions continue, each new transaction comes with the risks of overpaying and failing to achieve cost synergies as well.

Due to its capital-intensive operations, extremely competitive markets, and use of leverage, International Paper has a spotty track record with dividend growth. From 1995 through 2008, the company maintained a fixed dividend of 25 cents per quarter. However, this regular dividend was cut by 90% during the financial crisis.

While the firm has spent the last nine years growing the dividend at a decent clip (average of 11% annually over the last five years), it is still too early to determine whether International Paper’s slow-growing and cyclical business can support consistent dividend growth throughout a full global economic cycle.

At the very least, International Paper’s business model, trapped in a commodity business with little growth and potentially peaking operating conditions, is likely to result in much slower dividend growth in the coming years.

Closing Thoughts on International Paper

International Paper has done a nice job transforming its business as the world transitioned away from physical paper. The company’s focus on higher-margin pulp and boxes has allowed it to structurally improve its free cash flow generation and profitability over the past decade.

That being said, much of International Paper’s turnaround was a result of factors that will be hard to replicate going forward. And with traditional paper sales continuing to decline rapidly, it seems likely that International Paper will struggle to grow its dividend at a meaningful pace in the long-term. This is especially true given the firm’s debt-laden balance sheet and ongoing plans to continue consolidating smaller peers in its attempt to grow through acquisitions.

Combined with International Paper’s poor long-term track record of dividend growth, low risk income investors might want to steer clear of this paper products giant.

Leave A Comment