Sherwin-Williams (SHW) was founded in 1866 and is the world’s largest paint and coatings company, selling its products to professional, industrial, commercial, and retail customers in over 120 countries. The firm’s well known brands include Sherwin-Williams, Valspar, Dutch Boy, HGTV HOME by Sherwin-Williams, Krylon, Minwax, Cabot, and Thompson’s Water Seal.

Sherwin-Williams primarily serves the needs of architectural and industrial painting contractors and do-it-yourself homeowners through a network of more than 4,600 company-operated retail stores, but it also sells some industrial coatings, automotive finishes, and protective and marine coatings.

The company operates through three business segments:

- Americas Group (61% of 2017 sales): operates the exclusive outlets for Sherwin-Williams branded paints, stains, supplies, equipment and floor covering in the U.S., Canada and the Caribbean. This segment also manufactures and sells a wide range of architectural paints, industrial coatings, and related products across Latin America through company-operated stores and dedicated dealers.

- Performance Coatings Group (25% of sales): comprised of Valspar Coatings, Valspar Automotives, and the Global Finishes group.

- Consumer Brands Group (14% of sales): sells a broad portfolio of branded product lines through a variety of independent retail outlets in the United States, Canada, United Kingdom, China, Australia and New Zealand.

Following its acquisition of Valspar, Sherwin-Williams derives close to 75% of its revenue from the U.S. Sherwin-Williams has been raising its dividend for 40 consecutive years, meaning it’s a dividend aristocrat and just 10 years away from becoming a dividend king.

Business Analysis

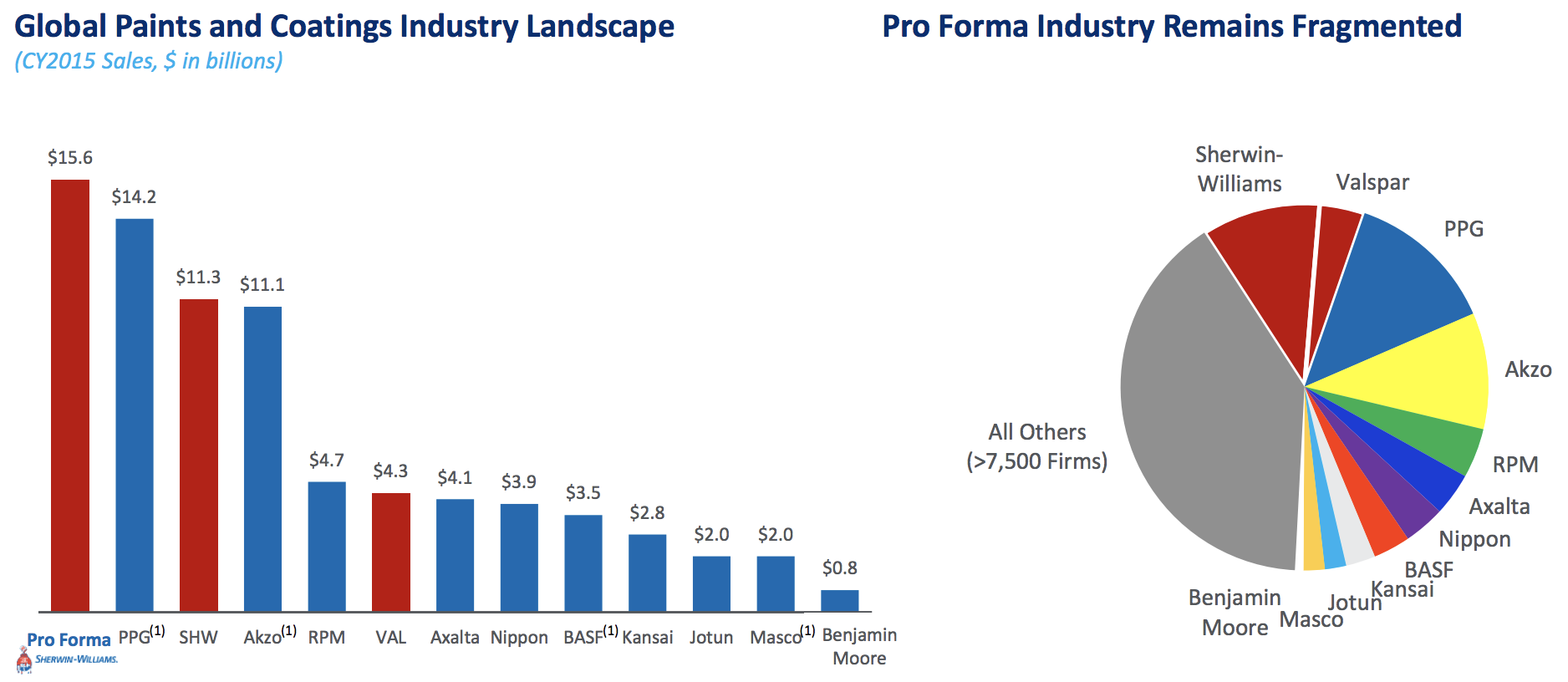

Sherwin-Williams is the leader in the global paint market, which generated $125 billion in sales in 2017. The company has approximately 12% market share in this highly fragmented industry (about 33% share in the U.S.). While the top 10 players control the majority of market share, there are over 5,000 total competitors.

Why so many rivals? The barriers to entry are rather low given the capital light nature of the industry. For example, Sherwin-Williams spent just 1.4% of revenue on capital expenditures (maintaining and growing production and distribution capacity) in 2017. Over time, management expects that level to remain at 2% or below even with much larger levels of investment following the firm’s Valspar acquisition. However, just because Sherwin-Williams’ competitors number over 5,000 doesn’t mean the firm lacks competitive advantages.

For one thing, Sherwin-Williams enjoys the industry’s largest global distribution network thanks to its network of over 4,600 company-owned stores. In fact, 90% of the U.S. population lives within 50 miles of a Sherwin-Williams location, and management eventually wants to increase its North American store count to about 5,000 (up from 4,000 at the end of 2017). In contrast, PPG Industries (PPG), the industry’s second largest company, has just over 1,000 global stores.

Then there’s the company’s strong portfolio of leading and trusted brands. Contractors, who currently make up 68% of the painting market (the other 32% are do-it-yourself consumers), trust Sherwin-Williams’ paints, sealers, and coatings to help them get the job done faster and more profitably.

That’s because Sherwin’s premium products are known to be more durable, take less time to apply (one coat instead of two), and dry faster. And because paint costs usually represent just 15% of a contractor’s total costs, Sherwin-Williams’ trusted brands result in strong pricing power, including a 3% to 5% price hike the company initiated in October 2017.

As a result of Sherwin-Williams’ large network of stores, long operating history, strong brands, and direct in-store relationships with customers, it has built up number one brands in architectural paint, stain & protective finish, aerosol paint, auto specialty paint, painting tools, and wood sealers.

In addition to strong pricing power, Sherwin-Williams’ margins also benefit from the company’s vertical integration. Big-box retailers must pay wholesale prices for their paint inventory, but Sherwin-Williams produces its own coatings, resulting in higher profits. The business also requires little capital, helping Sherwin-Williams consistently generate excellent free cash flow.

Not surprisingly, Sherwin-Williams has earned superior shelf space in major big-box retailers. The company’s scale and reputation mean it is also able make exclusive deals such as the partnership it recently announced with Lowe’s (LOW) to be its only nationwide supplier for interior and exterior paints. Sherwin-Williams plans to increase its training, display. and marketing budget in 2018 by about 3% in order to maximize the long-term sales and earnings boosting power of that deal.

The combination of strong pricing power, vertical integration, and a large retail store base has allowed Sherwin-Williams to obtain industry leading profitability with an operating margin near 10%.

However, Sherwin-Williams’ profits have been temporarily depressed by its recent purchase of Valspar, which was the company’s 22nd acquisition in the last decade. Due to the highly fragmented nature of this industry, acquisitions are a frequent way for companies like Sherwin-Williams to grow their market share (and thus their economies of scale).

The $11.3 billion Valspar acquisition, which closed in June 2017, greatly expanded the company’s commercial and foreign presence. Valspar brought the number two do-it-yourself paint brand in the U.S., strong market share positions in packaging and coil segments, over 10,000 distribution points, and numerous new technologies (including 20 new product lines).

The deal also gave Sherwin-Williams more exposure in international markets, which accounted for 50% of Valspar’s revenue, and helps the company sell more product through big-box retailers such as Lowe’s, Home Depot, and Ace, where Valspar already has a large presence.

The merger between Sherwin-Williams and Valspar combined the third and fourth largest players in the industry to create the world’s number one paint and performance coatings manufacturer, surpassing PPG in size.

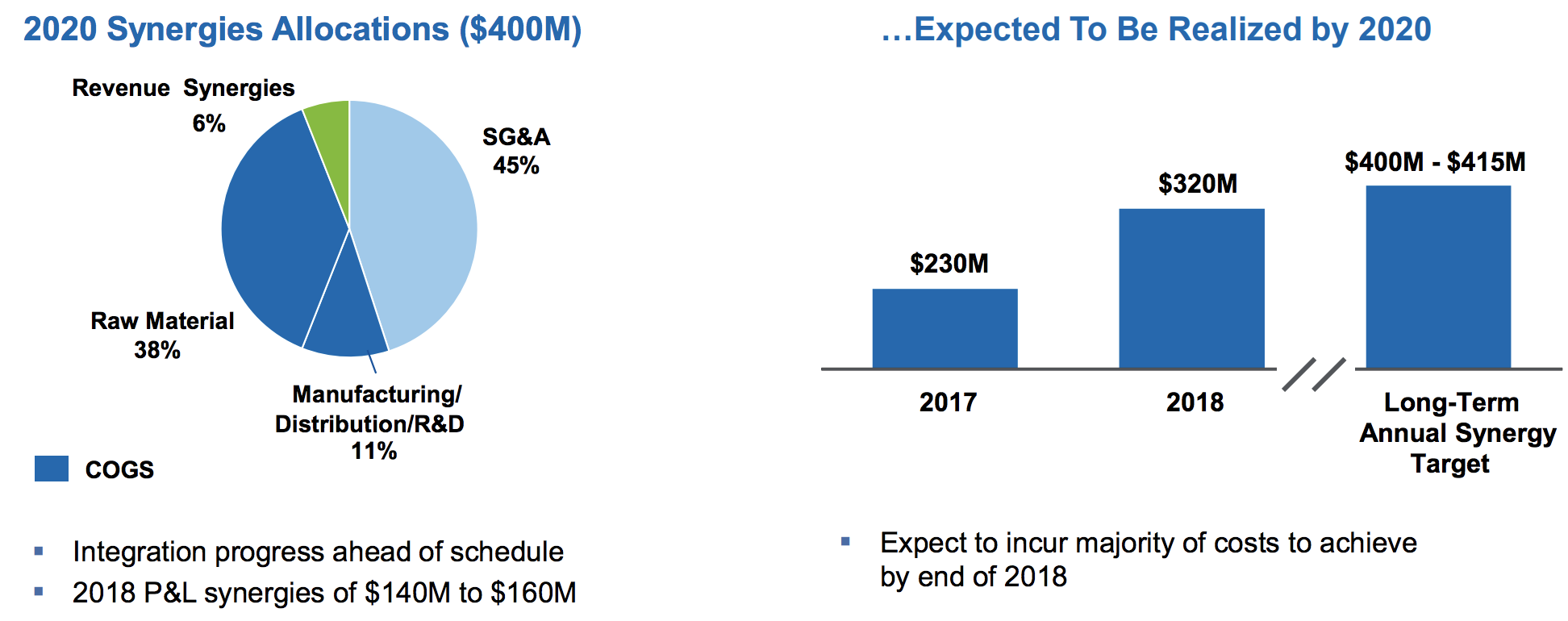

Management believes that in addition to obtaining far more long-term growth opportunities (especially in international markets), Valspar can help Sherwin-Williams boost its overall profitability thanks to over $400 million in annual cost synergies it can achieve by 2020, largely from cutting overlapping expenses.

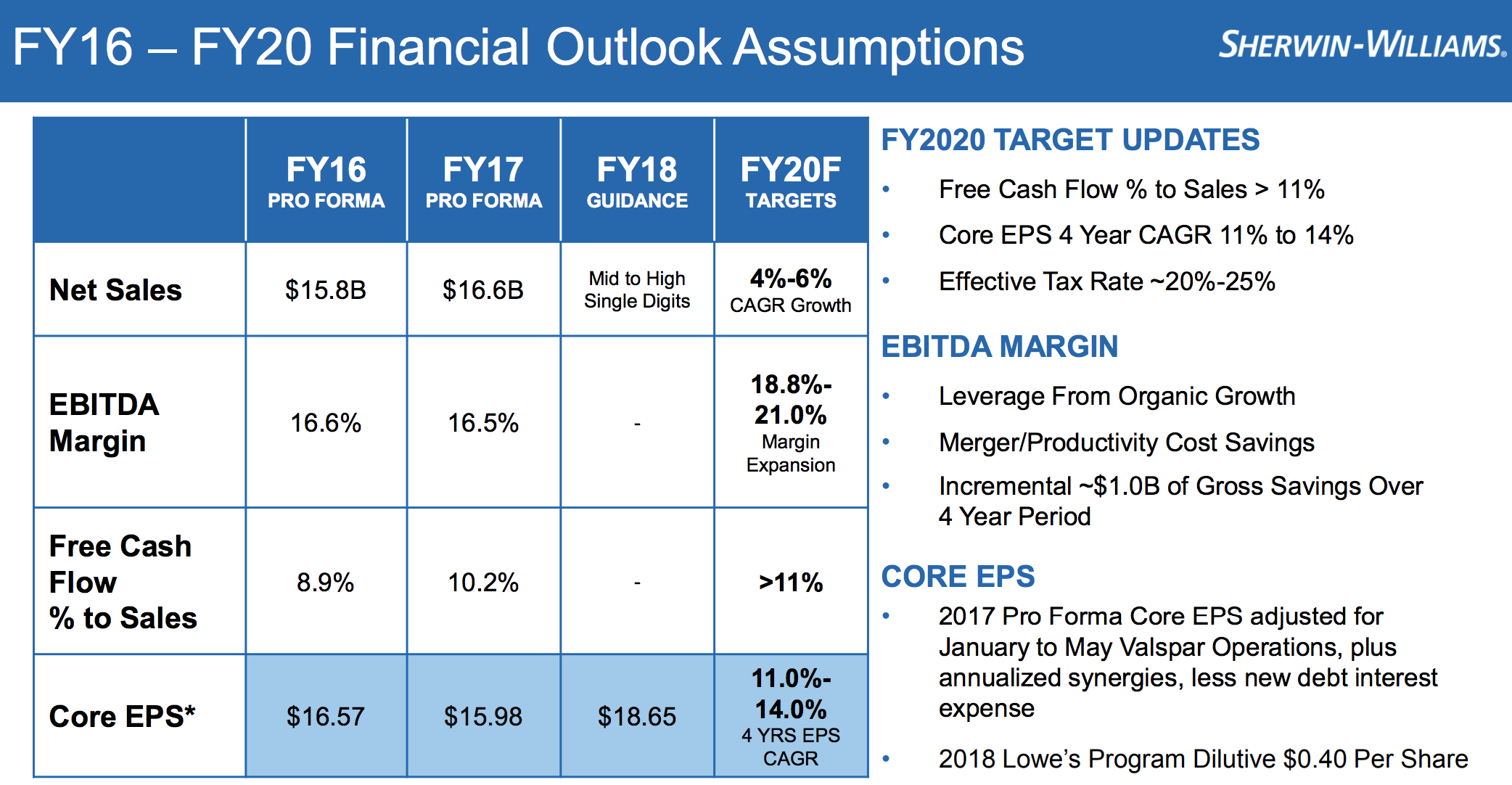

Over time, management is guiding for a 200 basis point increase in overall margins, including a free cash flow margin of 11% (up from around 9% today). Free cash flow is what’s left over after running the business and investing for future growth. It is used to fund dividends and buybacks and repay debt.

Through 2020 the company expects to achieve about 5% organic sales growth. That growth is likely to come from steady growth in residential construction, such as the 1.3 million new homes expected to be built in the U.S. in 2018. The financial crisis caused new home starts to fall off a cliff and badly trail new household (family) formation which has been running about 1.4 million per year. Or to put it another way, U.S. housing demand has outstripped supply so construction of new homes (as well as remodeling and repainting to help sales of existing homes) should help continue driving Sherwin-Williams’ top line for several more years.

Thanks to Valspar synergies and ongoing margin expansion from cost cutting, mid-single-digit sales growth should translate into significantly higher margins and 11% to 14% annual growth in earnings per share for the foreseeable future.

Once management has finished deleveraging Sherwin-Williams’ balance sheet from the Valspar acquisition (more on this in a moment), the company plans to return to paying out about 30% of EPS and FCF per share in dividends (compared to a payout ratio near 20% today). In other words, Sherwin-Williams should be capable of long-term dividend growth of 12% to 13% per year, which would make it one of the fastest growing dividend aristocrats (40 straight years of dividend growth).

That being said, there are several risks investors still need to keep in mind.

Key Risks

The biggest risk to Sherwin-Williams’ long-term future is arguably market saturation in the U.S. The company has significantly more stores than its next largest peers and enjoys a strong presence in most regions already.

If Sherwin-Williams finds fewer opportunities for profitable store growth than it currently expects, the stock could find itself in trouble. Though the company’s international footprint has improved with the Valspar acquisition, it is still highly dependent on U.S. growth opportunities.

Additionally, Sherwin-Williams’ market seemingly has few barriers to entry – no one can stop Home Depot or other competitors from building new stores in a location and pressuring prices – but the company’s brands, reputation, and specialization (i.e. controlled channel model) help mitigate risk from new competition, including Amazon. Valspar also makes Sherwin-Williams a more attractive partner for big retailers, as demonstrated by the recent deal with Lowe’s.

Over the short term, it also needs to be pointed out that Sherwin-Williams operates in a cyclical industry where demand for paint is tied to the health of the overall economy (especially the housing market). This is especially true during economic downturns when the use of contract painters declines and more price sensitive consumers tend to favor cheaper paint brands.

Fortunately, Sherwin-Williams has done a good job of continuing to win market share over time. That’s been because older people are generally less inclined to repaint their homes and are more likely to hire contractors, for whom Sherwin-Williams’ premium offerings are preferred. This trend is expected to continue for the foreseeable future except during economic downturns.

And while Sherwin’s 40th consecutive annual dividend increase certainly sets it among the elite of income growth stocks, keep in mind that the firm’s rate of its dividend growth is also cyclical. Dividend growth comes in boom and bust cycles where the company uses token dividend increases during the lean times to retain its dividend aristocrat record.

That’s why during the financial crisis, and for the years following, dividend growth was rather flat. In the past two years, the same has been true thanks to the large amounts of debt Sherwin-Williams had to take on ($11.5 billion in total) to acquire Valspar. This greatly increased its leverage and interest costs:

- Debt/EBITDA ratio: 4.1 (industry average 2.0)

- Interest coverage ratio: 7.6 (industry average 35.1)

- S&P Credit Rating: BBB

- Average Interest Rate on Debt (91% fixed rate): 3.0%

Management’s top priority is paying down that debt with retained free cash flow. The company has said that it won’t accelerate dividend growth until it has deleveraged to a debt/EBITDA ratio of 2.0 to 2.5 which it believes will get it a credit rating upgrade to BBB+. Management expects to hit a leverage ratio of 3.0 by the end of 2018 and believes it will be able to return the EPS payout ratio to about 30% by 2020.

However, if the company’s margins end up coming in below expectations (perhaps due to commodity price volatility for key inputs such as oil-based materials and titanium dioxide), or the Valspar synergies fail to materialize, then dividend growth lovers might be stuck with token 1% increases for longer than expected.

Finally, in a fragmented industry where acquisitions are common, there is execution risk with any deal. Sherwin-Williams’ track record on not overpaying for assets (it paid 15x forward EBITDA for Valspar) and hitting synergistic cost targets is better than most. However, in the past year integration costs for the Valspar deal have been higher than expected, showing that even good management isn’t perfect.

Fortunately, large acquisitions like Valspar are rare with Sherwin-Williams preferring to spend its free cash flow on buybacks and dividends. Only about 30% of its free cash flow has ended up going to bolt-on acquisitions over time, including purchasing regional paint stores to expand its retail footprint.

Closing Thoughts on Sherwin-Williams

Sherwin-Williams’s long-term focus on building a portfolio of trusted brands, maintaining the industry’s largest distribution network, and executing acquisitions to consolidate the industry has proven to be a winning strategy.

A conservative corporate culture has ensured 40 years of uninterrupted dividend growth, and the company should quickly be able to reduce its debt levels thanks to its large amounts of retained free cash flow. Combined with a strong growth driver in the form of pent-up demand for housing, Sherwin-Williams should continue generating some of the fastest dividend growth of any dividend aristocrat over the long term.

To learn more about Sherwin-Williams’ dividend safety and growth profile, please click here.

Leave A Comment