PPG Industries (PPG) was founded in 1883. Today the company is a leading supplier of paints, coatings, and specialty materials to customers in construction, industrial, marine, automotive, refinishing, packaging, and aerospace markets. Coatings provide protection, performance, and decoration for a wide range of products, improving their durability and marketability.

Approximately 60% of PPG’s sales are special-purpose coatings (aerospace, automotive OEM, general industrial, packaging, marine, etc.) with the remaining 40% related to architectural applications.

By geography, 43% of PPG’s 2017 sales were generated in North America, 30% in Europe, Middle East, and Africa (EMEA), and 27% in Asia Pacific and Latin America. In total, PPG has a presence in more than 70 countries.

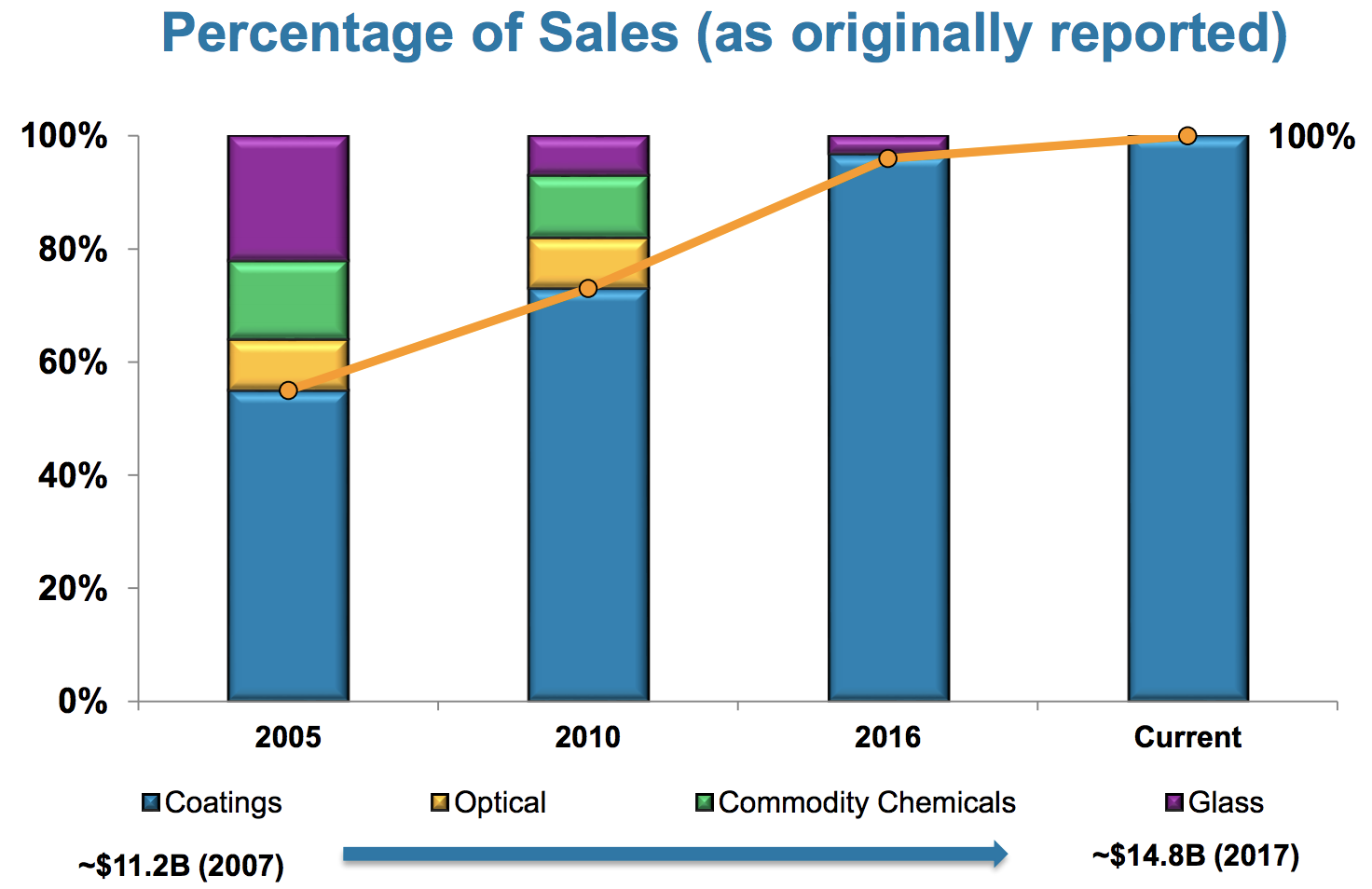

After selling its fiber glass division, PPG completed its multi-year portfolio transformation to focus the business completely on coatings, which carry the strongest margins and long-term growth opportunities for the company.

PPG has just two segments focused exclusively on high performance industrial coatings.

- Performance Coatings (57% of sales): comprised of the refinish, aerospace, protective and marine, and architectural (Americas, Asia Pacific, and EMEA) coatings businesses.

- Industrial Coatings (43% of sales): comprised of the automotive OEM, industrial coatings, packaging coatings, coatings services, and specialty coatings and materials businesses.

With 46 consecutive years of annual dividend increases, PPG Industries is a dividend aristocrat and will become a dividend king (50+ straight years of payout growth) in 2021.

Business Analysis

Coatings are essential materials that make products last longer and look more appealing. For example, they make cars more resistant to corrosion and beverage cans more visually appealing.

However, some categories of coatings are more valuable than others. Consumers looking to repaint part of their home are going to be more sensitive to the price of paint (they perceive it as being an undifferentiated product) than an original equipment manufacturer (OEM) that is trying to improve the fuel efficiency and durability of its vehicles.

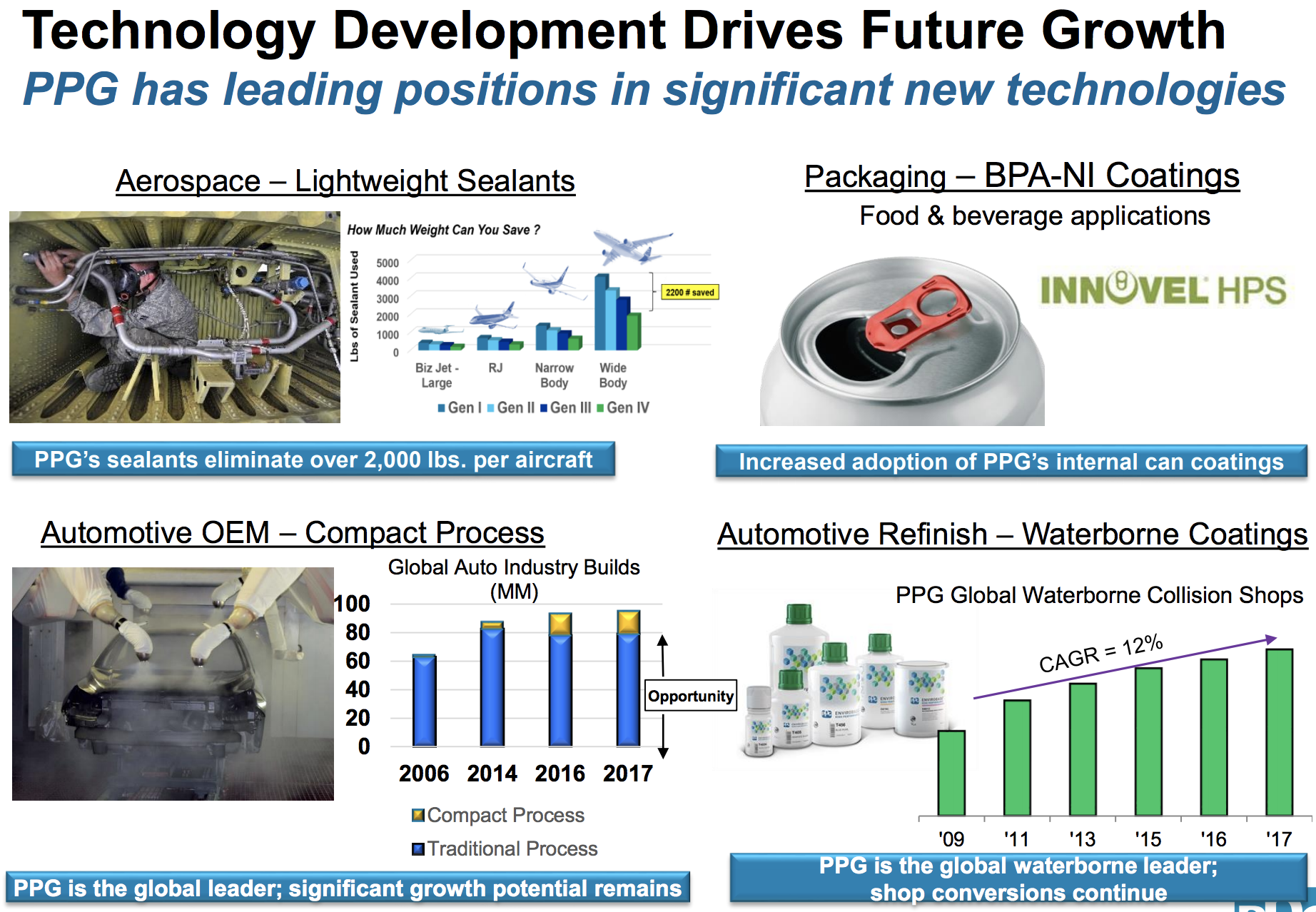

As previously mentioned, the majority of PPG’s (60%) are special-purpose coatings, which target higher-value applications. The company is able to pursue these more complex and higher-margin opportunities because it has historically invested 3% of sales in R&D, which amounted to $474 million last year.

As a result of its investments, PPG’s coatings are better able to protect its customers’ assets in some of the world’s most demanding conditions and environments and attain higher margins than most of its peers.

In automotive markets, for example, PPG Industries’ coatings can be applied on numerous substrates including fiberglass, composites, and metallic surfaces for resistance to corrosion, chemicals, and rain erosion.

PPG’s coatings also take advantage of a “wet-on-wet” application process that reduces the number of steps necessary to paint a vehicle by eliminating the primer layer, lowering customers’ capital costs and requiring less energy.

In aerospace markets, PPG’s lightweight sealants can reduce over 2,200 pounds per plane, improving aircraft fuel efficiencies. Simply put, PPG’s specialized performance coatings are superior in the most important ways in each industry it operates in.

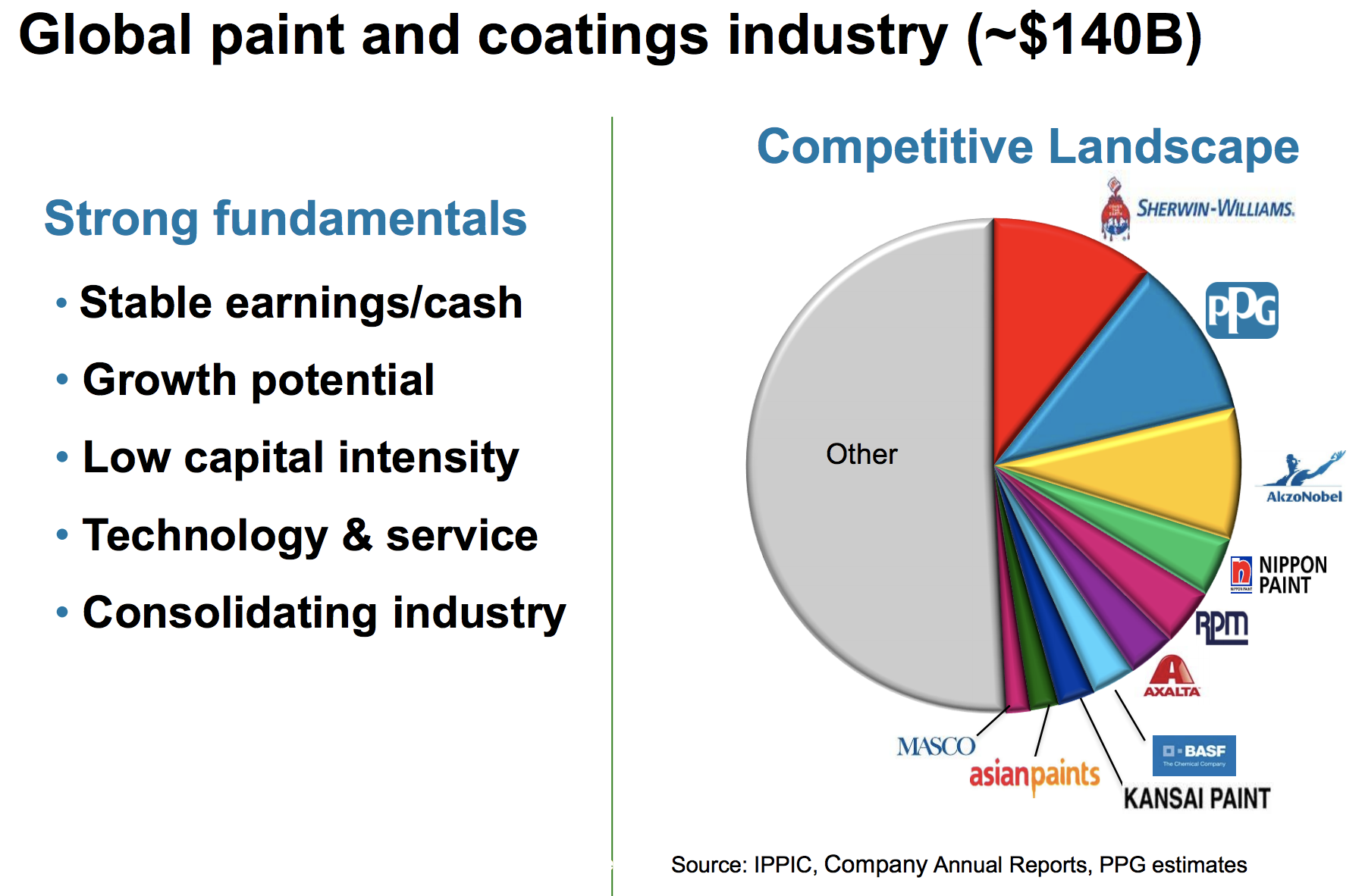

Overall, PPG is the second largest company (11% market share) in the $140 billion global paint and coatings industry that’s growing at 3% to 4% per year. This is a highly fragmented industry with over 5,000 global competitors that is consolidating over time.

PPG’s goal is to dominate its higher margin niches where it retains strong pricing power due to the superior durability and performance of its products. Thanks to its global distribution, economies of scale, and focus on specialty products, PPG maintains number one market share positions in aerospace and automotive OEM markets. The company is also number two in packaging, architectural, and refinish / collision markets. Over time PPG believes it can get to the first or second position in all of the end markets and countries it operates in.

To profitably grow its business, PPG focuses on two main strategies. First, it defends its market share via long-standing relationships with customers that sometimes span decades. And because many of its products are specifically designed with customers’ unique applications in mind, PPG creates higher switching costs in several of its key businesses. The firm also has one of the industry’s largest distribution systems which is hard and costly for rivals to replicate.

The company’s second strategy is growing market share via bolt-on acquisitions to consolidate various performance coating makers under its roof. Over the past decade PPG has made over 50 acquisitions, mostly smaller deals (its largest deal in last decade was for $3.5 billion) to further expand its portfolio of premium niche brands. In 2016 and 2017, the company spent $310 million and $355 million on several acquisitions, respectively. These purchases have boosted the company’s average annual sales growth by 5% over time.

There are two primary reasons behind PPG’s small acquisition-focused strategy. First, smaller deals are usually far more profitable because PPG can avoid overpaying for a larger rival. Integrating new niche product lines into its existing distribution channels is also much easier than trying to combine two large global supply chains.

The second reason for frequent small purchases is because of the niche nature of the industries in which PPG operates. Commercial customers are usually very loyal to existing suppliers. This is because performance coatings are mission-critical inputs that represent a relatively small portion of a product’s overall cost. However, they provide essential product improvements that are critical to a client’s ability to maintain or gain market share.

Once a company comes to trust a supplier, it usually doesn’t shop around for a better price elsewhere. As a result, the performance coating industry is dominated by numerous entrenched players. By acquiring smaller rivals, PPG can gain the long-standing relationships of the acquired company as well as expand its premium product offerings with acquired intellectual property (patents).

In addition, acquisitions such as the $1.5 billion Comex deal of 2014 helped increase PPG’s presence in fast-growing Latin America. Comex paint is sold in 4,400 retail locations in Mexico and Central America, and the subsidiary is opening one new store every other day.

Besides buying businesses, PPG maintains a sharp focus on increasing the efficiency and profitability of its operations as well. In 2015, the company announced a large-scale restructuring coinciding with the industrial recession (caused by crashing commodity prices including energy). The goal was to double down on cost synergies from its last several years of acquisitions.

Then, in 2016, PPG expanded the restructuring to include the sale of more commoditized product lines including the chlor-alkali business (lye and caustic soda). Ultimately the new management (current CEO Michael McGarry took over in 2015) decided to completely divest PPG’s fiber glass unit to focus on faster growing and higher-margin performance coatings.

Thanks to its strong pricing power (from its trusted brands), some of the largest economies of scale in the industry, and the completion of its restructuring, PPG enjoys double-digit operating margins and returns on invested capital.

Another aspect to like about this business is that approximately half of PPG’s coatings sales are related to aftermarket and maintenance coatings, which generates a stable base of cash flows each year. Producing coatings also requires relatively little capital which, when combined with PPG’s excellent margins, results in impressive free cash flow generation each year.

Going forward, management’s goal is to use about 60% of operating cash flow to grow the business via a 3:2 ratio of organic growth investments and acquisitions. The remaining 40% of cash flow is returned to shareholders via buybacks and dividends.

PPG maintains a very conservative balance sheet despite its acquisitive nature. The firm earns an A- credit rating from Standard & Poor’s, providing the business with plenty of flexibility to execute on its long-term growth plans while paying a very safe and growing dividend.

PPG can likely compound its earnings at a high single-digit pace in the years ahead. The coatings market should grow by around the same pace as global GDP (3% per year), and PPG will likely continue making acquisitions (1-2%), repurchasing shares (1-2%), and expanding margins via productivity gains and sales mix improvements (1-2%). The firm’s dividend will likely grow at a similar rate.

Key Risks

Over the near term, changes in key raw material prices (e.g. titanium dioxide) can whip around PPG’s profits. The health of key end markets such as construction and automotive will also impact demand for PPG’s coatings any given quarter. Being a global company headquartered in the U.S., currency appreciation can serves as a headwind on short-term growth as well.

However, none of these risks seem likely to impact PPG’s long-term earnings power.

Thinking further out, coatings will almost certainly continue to be used for many years to come. It’s hard to imagine a new technology displacing coatings, so perhaps the bigger risk is that competitors reduce their technology gap with PPG, which begins to pressure the industry’s margins.

On the consumer-facing side, where PPG still has a large consumer paint division, competition is especially fierce, and the loss of major distribution deals can negatively impact results. For example, in early 2018 Sherwin-Williams (SHW), the largest coatings maker in the world, signed an exclusive deal to sell its paints in Lowe’s (LOW), America’s second largest home improvement chain. This means that PPG’s paints will lose a valuable source of distribution that will cost it some revenue.

There’s also the chance that management pursues a significant acquisition to boost growth, which could come with significant financial and operational risks. In early 2017, PPG offered to acquire Dutch paint maker Akzo Nobel for $29.5 billion. This was after already buying that company’s North American paint division in 2013. The larger deal was called off after three months due to large-scale pushback from Dutch politicians and repeated legal challenges from shareholders and rivals.

While such mega deals can ultimately prove successful, they are also the hardest to pull off due to the risks of overpaying as well as merging large and well-established corporate cultures and supply chains.

Overall, the most likely risk to transpire over the next few years is a downturn in PPG’s core end markets, which it can do little to protect against.

Closing Thoughts on PPG Industries

Other than its relatively low dividend yield and sensitivity to raw material prices, foreign currency fluctuations, and cyclical end markets such as construction, there’s really not much to dislike about PPG.

The company appears to be well-positioned in numerous profitable niches, has a leading portfolio of mission-critical coatings technologies, regularly pushes through price increases, and generates excellent free cash flow each year. With around 10% share of the global market, a presence in numerous emerging markets, and a strong balance sheet to support future acquisitions, growth opportunities shouldn’t be a problem either.

To learn more about PPG’s dividend safety and growth profile, please click here.

You don’t mention the accounting problems. Does that mean you have no worries, or do you just discount the odds that it is anything too terribly material?