Founded in 1887, Old Republic International (ORI) engages in insurance underwriting primarily in the U.S. and Canada. The firm owns 134 subsidiaries that operate in all 50 states, 10 Canadian provinces, and three U.S. territories.

Old Republic International operates through two main segments: General Insurance Group and the Title Insurance Group, which together generated $6.3 billion in revenue in 2017.

- General Insurance Group (59% of revenue): offers automobile extended warranty, aviation, commercial automobile, commercial multi-peril, general liability, home warranty, inland marine, travel accident, and workers’ compensation insurance products. About 68% of total premiums are from workers compensation and trucking insurance.

- Title Insurance Group (39% of revenue): offers lenders’ and owners’ title insurance policies to real estate purchasers and investors based upon searches of the public records. This segment also provides escrow closing and construction disbursement services; and real estate information products, national default management services, and various other services pertaining to real estate transfers and loan transactions.

The company also has two very minor segments (mortgage default insurance and life/accident insurance) that combined to provide about 3% of revenue in 2017.

The small life and accident insurance business is also conducted in the U.S. and Canada, principally as an adjunct to the Company’s general insurance operations.

The mortgage insurance business is being run off, meaning no new policies are being written as Old Republic anticipates ending this business line by 2022 or 2023.

Business Analysis

The insurance business can be challenging for investors to understand and for insurance companies to maintain consistent growth. That’s because it’s all about risk management and is a cutthroat industry with numerous firms competing primarily on price.

An insurance company makes money two ways. First, it needs to price its risk appropriately, meaning that future claims and operating expenses associated wit the business cost less than the premiums received from all of the policies outstanding.

The combined ratio (which Old Republic calls its “composite ratio”) measures an insurer’s profitability by dividing its total costs (including claim-related losses) by its total revenue. If a combined ratio is over 100% it means that an insurance company is making a loss on its policies and likely underpricing risk. A combined ratio under 100% means the company is earning a profit on its policies.

In 2017, the company’s business segments were all profitable except for the run-off business lines, which consist of mortgage and consumer credit default insurance that the company is no longer writing new policies on.

In total the company generated 3.3% profits on its policies in 2017 (a 96.7% composite ratio), and adjusting for one-time litigation expenses related to the Great Recession, the composite ratio was 94%. Over the past 10 years, Old Republic’s composite ratio has averaged 97.1%, but management thinks that in the long term the business can achieve 95%, indicating a 5% net profit margin on its insurance policies.

Improved underwriting profitability is expected for two reasons. First, Old Republic’s exit from mortgage and consumer loan default insurance means less losses going forward.

In 2011 and 2014, the mortgage insurance and consumer credit default businesses had composite ratios of 262% and 503%, respectively. In other words, the company lost a lot of money on those policies.

With those businesses now running off (no new policies are being issued, so they will eventually roll off the balance sheet), the company’s policy profitability should improve. In addition, Old Republic has been focusing more on title insurance, which accounts for close to 40% of company-wide revenue today and has very attractive economics.

Title insurance protects real estate buyers and mortgage lenders from damages in case the seller does not have free and clear ownership of the property. The premium for title insurance is paid all at once, when the real estate deal closes. In other words, Old Republic gets all the premium up front, and then pays off any claims that arise very slowly over time.

Which brings us to the second way that insurance companies make money, what’s known as “float.” Float is the money an insurance company collects from policy premiums and holds until claims are actually made and paid out. Float can be invested into income-producing assets such as stocks and bonds.

At the end of 2017, Old Republic had $13.3 billion of float invested, mostly in high-quality fixed-income (bonds) investments. About 25% of the portfolio was invested in stocks, which earn a higher return over time but tend to be more volatile.

The key to a good insurance company investment is how well it manages risk, both with its underwriting of policies as well as its investments. Old Republic is one of the most conservative insurance companies in America.

That can be seen in the firm’s highly diversified portfolio of policies, which are made to large companies, small companies, and individual consumers. These policies allow Old Republic to benefit from the growth in almost every sector of the U.S. economy.

Importantly, management has intentionally limited the company’s property exposure, reducing Old Republic’s exposure to potentially devastating claims arising from catastrophic events.

Old Republic Sources Of Policy Premiums

In addition, the company is careful to be highly geographically diversified in order to avoid being overexposed to any single part of the country that’s struggling, which could result in large policy losses.

Finally, there’s management’s approach to investing, where it’s highly conservative and disciplined style also gives it an edge over many of its more aggressive rivals.

“The investment philosophy is therefore best characterized as emphasizing value, credit quality, and relatively long-term holding periods. The Company’s ability to hold both fixed maturity and equity securities for long periods of time is in turn enabled by the scheduling of maturities in contemplation of an appropriate matching of assets and liabilities, and by investments in large capitalization, highly liquid equity securities. To this end, the investment portfolio contains no significant insurance risk-correlated asset exposures to real estate, mortgage-backed securities, collateralized debt obligations (“CDOs”), derivatives, hybrid securities, or illiquid private equity investments. Moreover, the Company does not engage in hedging or securities lending transactions, nor does it invest in securities whose values are predicated on non-regulated financial instruments exhibiting amorphous or unfunded counter-party risk attributes.”

These quotes from the company’s annual report exemplify Old Republic’s long-term and conservative approach to investments. Whereas some insurance companies that lose money on underwriting are forced to make up those losses with large investment gains, Old Republic doesn’t share that problem.Not surprisingly, management takes a similarly conservative and long-term view with Old Republic’s underwriting business:

“In light of the above factors, the Company’s affairs are managed for the long run and without significant regard to the arbitrary strictures of quarterly or even annual reporting periods that American industry must observe. In Old Republic’s view, such short reporting time frames do not comport well with the long-term nature of much of its business. Management therefore believes that the Company’s operating results and financial condition can best be evaluated by observing underwriting and overall operating performance trends over succeeding five- or preferably ten-year intervals. A ten-year period in particular can likely encompass at least one economic and/or underwriting cycle and thereby provide an appropriate time frame for such cycle to run its course, and for premium rate changes and reserved claim costs to be quantified and emerge in financial results with greater finality and effect.”

The firm’s consistent profitability on its policies means that it can take a conservative approach of earning modest returns on lower risk investments that match its liabilities with its assets (similar to how pension funds and sovereign wealth funds work).

Such operating discipline has helped build one of the company’s most important competitive advantages, which is its long operating history. The longer an insurance company operates in specific policy industries, the more actuarial data it can accumulate.

As a result, its statistical risk database becomes very robust and allows an insurer to more accurately predict future policy claims and price policies in such a way as to generate increasingly consistent profits over time.

Old Republic’s lengthy history has also helped the company establish a robust distribution network of independent agencies and brokerage channels, ensuring that its policies reach as many customers as possible. As the firm builds an ever-larger customer base, it can further spread risk across its portfolio, resulting in steadier earnings over time.

Here’s a look at how long some of the company’s various segments have been in business:

- Title Insurance: 1907

- Worker’s Compensation: 1910’s

- General Liability: 1920’s

- Inland Marine: 1920’s

- Commercial Multi-Peril: 1920’s

- Commercial Automobile Insurance: 1930’s

- Travel Accident: 1970

- Home Warranty Insurance: 1981

- Aviation: 1983

- Automobile Extended Warranty Insurance: 1992

With a track record of decades, if not 100+ years in some of its subsidiaries, Old Republic has one of the deepest actuarial data sets in the industry. This is a key reason why it’s able to achieve very good composite ratios and recorded a 9% net margin in 2017.

That’s in comparison to the industry average of 8.0%. While 1% higher profitability may not sound like much, in a highly competitive and fragmented industry such as this, it shows that Old Republic is able to manage its risks very well and still earn outsized profits for investors.

All told, Old Republic’s combination of conservative underwriting and disciplined investment of its float has allowed the insurer to generate an impressive dividend track record. The company has paid a dividend for 77 straight years and has increased its payout every year for the last 36.

Going forward, Old Republic’s long-term earnings and dividend growth rate is unlikely to dazzle, but shareholders can likely expect consistent mid-single-digit increases. A lower composite ratio as the firm’s loss-inducing run-off portfolio matures, steady economic growth, and a strong housing market should all help drive growth.

However, there are several major challenges facing Old Republic that could reduce the firm’s future growth potential. The specialized nature of this industry, and management’s approach to it, might result in dividend growth being too low to meet the needs of many income growth investors.

Key Risks

Old Republic is certainly one of the most conservatively run insurance companies, but it still faces three main risks that investors need to be aware of.

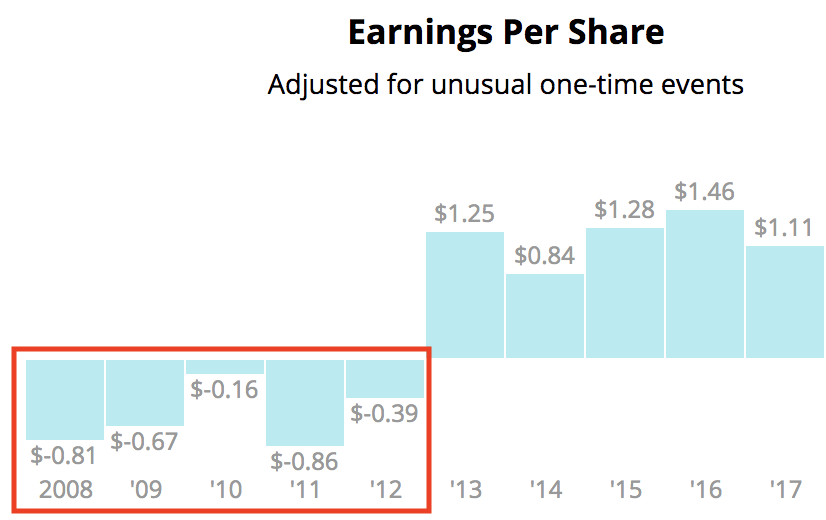

For one thing, as good as management has been at risk management over the decades, the firm’s track record isn’t perfect. For example, the mortgage insurance and consumer credit insurance businesses really hurt the company during the financial crisis.

While Old Republic was not speculating like some larger insurance companies (such as AIG) with credit default swaps on dangerous derivatives, the housing bubble bursting still resulted in several years of major losses during the downturn.

Fortunately, the company’s strong balance sheet and core businesses allowed it to retain its dividend growth streak and continue raising its payout (by about 1% per year).

Old Republic is getting out of insurance and consumer credit insurance businesses, but that doesn’t mean it won’t still face earnings volatility in the future. For one thing, the lucrative title insurance business is highly dependent on strong housing and commercial real estate markets which are tied to the health of the U.S. economy. In a future downturn, this business segment is likely to weigh on the company’s earnings growth.

In addition, insurance is a highly regulated industry, mostly at the state level. However, Federal regulations have become tighter in recent years, including proposals to change certain laws that could adversely affect the company’s workers comp claims going forward.

For example, in 2001 and 2002 the Department of Labor revised Federal black lung regulations that increased the ability for employees in the mining industry to file for workers compensation. This was on top of changes in the 1980’s that addressed increasing asbestos claims, which the company was also exposed to.

Then, in 2010, healthcare reform once more increased the ability of workers affected by black lung to file additional claims. While Old Republic has adequate reserves for these claims, such regulatory changes can result in the company having to increase capital reserves, which can negatively affect profitability.

In addition to regulatory and long-tail risks associated with various industries (such as housing), keep in mind that, like most insurance companies, Old Republic’s profitability is highly dependent on the profitability of its portfolio. In 2017, approximately 73% of its net income was generated by returns on invested float.

Old Republic’s portfolio has been gradually increasing its exposure to stocks, increasing its equity mix from 7% of its investment portfolio in 2012 to about 25% in 2017. This has helped boost the company’s earnings during the second longest and strongest bull market in U.S. history.

But while the portfolio itself is mostly in low-risk blue-chip stocks, all stocks can experience extreme volatility at times. Rising U.S. interest rates have also been helping boost income earned by the fixed-income portion of the portfolio.

During the next recession, however, a combination of falling interest rates and stock prices is likely to result in a significant decline in earnings growth.

Future growth could also be challenged by the firm’s strict underwriting discipline. Management simply isn’t willing to take excessive risks, such as undercutting rivals on pricing to win market share, which can result in weak short-term performance despite being in the company’s best interest.

Ultimately, Old Republic’s business model, which is all about managing long-term risk in a highly conservative fashion, might not allow for very fast dividend growth over time. This may be why management declared a special dividend of $1 per share in January of 2018, rather than increase the regular dividend at more than a token rate of 2.6%.

Going forward, investors might have to accept a permanently slower dividend growth rate with the occasional special dividend. However, since special dividends in a highly cyclical industry are by definition unpredictable, this means that Old Republic might not be for all income investors (especially those looking for relatively fast and steady dividend growth).

Closing Thoughts on Old Republic International

Old Republic has proven itself to be one of the most conservatively run and disciplined insurance firms for more than 100 years. The company’s ability to manage risk appropriately has allowed it to consistently earn profits on its policies, as well as decent returns on its insurance float.

The result has been above-average profitability in an intensely competitive industry, as well as one of the best dividend growth track records of any business. That being said, Old Republic does operate in a highly cyclical industry, which is sensitive to the economy and the performance of stocks and bonds.

While the company is very likely to maintain its dividend growth streak for the foreseeable future, investors considering the stock should remain aware that Old Republic’s pace of dividend growth will likely remain somewhat slow.

To learn more about Old Republic’s dividend safety and growth profile, please click here.

Leave A Comment