HCP (HCP) is a healthcare REIT that went public in 1985 with 24 skilled nursing facilities (SNFs). Over the decades, the business eventually became a dividend aristocrat with 30 consecutive years of dividend growth. HCP’s success was fueled by acquisitions of over 1,200 new healthcare properties, including skilled nursing, medical office buildings (MOBs), life science properties, and hospitals.

After a major restructuring plan begun in 2016, the REIT spun off its troubled ManorCare SNFs into Quality Care Properties (QCP), reducing its dividend by more than 30% to reflect is smaller cash flow profile (HCP investors received one share in QCP for every five shares they held of HCP).

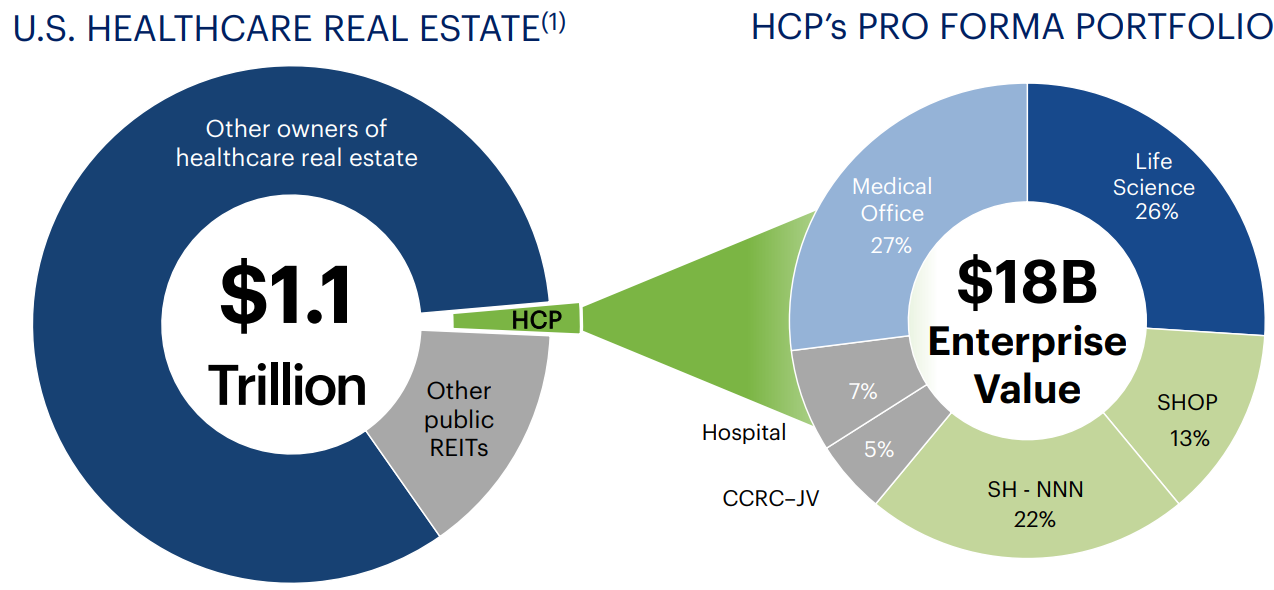

HCP has continued to make large asset sales in order to shift its portfolio of 828 properties towards healthier and faster growing markets, specifically senior housing, life sciences (research labs), and medical office buildings. These areas now make up over 90% of the firm’s net operating income after HCP’s latest restructuring deal is completed.

The restructuring also vastly diversified HCP’s tenant base, with its top three tenants now representing just 31% of net operating income (down from 54%), and 95% of cash flow will be derived from private payer (non-government) sources (versus only 78% previously).

Many of HCP’s investments are under master triple-net lease agreements, which tend to be viewed as lower risk contracts since the tenant is responsible for taxes, maintenance, and insurance. This makes HCP the landlord who merely collects high margin rent under long-term (12 to 15-year) leases with annual inflation-adjusted rental escalators.

Business Analysis

A primary appeal of the medical REIT industry is the aging U.S. population, which is expected to drive substantial growth in healthcare spending over the coming decades.

In fact, the percentage of Americans over the age of 80 is expected to triple between 2017 and 2023 to reach 4.5%.

And with roughly 10,000 Americans per day achieving retirement age, total U.S. healthcare spending is expected to increase by about $2 trillion per year by 2025, and consume about 20% of US GDP. Demand for all types of healthcare properties would presumably be lifted by this rising tide.

Currently the value of all U.S. medical properties is about $1.1 trillion and just 15% of the market is owned by publicly traded REITs like HCP, as well as large rivals such as Ventas (VTR) and Welltower (WELL). In other words, there could be a long growth runway for HCP to continue consolidating this fragmented industry, fueling higher dividends for many years to come.

However, HCP has run into some major hurdles in recent years thanks to changes in the healthcare industry. The Affordable Care Act (ObamaCare), while greatly increasing the number of Americans with access to healthcare, also created a large imperative for cost cutting. After all, medical inflation has been running about 2.5 times the rate of overall inflation for decades, an unsustainable trend.

Therefore, starting in 2015, the Centers for Medicare & Medicaid Services made major changes to government reimbursement for healthcare, with a strong focus on outcome-based pay rather than pay for service.

The result has been falling reimbursement rates and shorter stays in facilities like SNFs. Combined with steadily rising labor costs, this has pressured SNF operator occupancy and pushed margins lower for several years. As a result, many of HCP’s legacy SNF operators experienced falling cash flow/rent coverage ratios.

In contrast, medical office buildings have been thriving as both government and private insurance have been more focused on cutting costs by emphasizing outpatient visits compared to costly inpatient stays.

All of these factors led HCP to make the difficult decision in 2016 to spin off its 338 struggling SNF properties (purchased from ManorCare for $6.1 billion in 2011) into a new REIT, Quality Care Properties (QCP).

The spinoff allowed HCP to refocus on financially healthier industries and tenants. That same year the REIT also sold off large amounts of properties it owned as part of a joint venture with struggling senior housing company Brookdale Senior Living (BKD), a major tenant.

This divestiture allowed HCP to raise $3.8 billion, using almost all of the proceeds to pay down its debt. However, like ManorCare, Brookdale continues to struggle. While the firm derives most of its cash flow from private payers, its overall profitability remains very weak. In fact, Brookdale’s net margin in the past 12 months was 1.3% compared to the industry average of 4.0%.

More importantly, Brookdale’s senior housing properties were unable to cover their rent while also paying mortgage and interest costs. In November of 2017, HCP was forced to announce another major restructuring. HCP will:

- Sell six properties to Brookdale for $275 million

- Take a 10% stake in two joint ventures worth $99 million

- Terminate 68 Brookdale leases on senior housing properties

- Reduce Brookdale’s rent by $5 million per year on its remaining leases (increase operating cash flow/rent coverage to 1.09)

- Obtain the right to pay a termination fee to end the last 20 senior housing leases that Brookdale still has with HCP

In total, the restructuring means that HCP will become far less dependent on Brookdale. Before this deal, approximately 27% of HCP’s cash flow was coming from the distressed operator, but now that will fall to 15.7%.

HCP plans to either find new tenants to occupy the 68 old Brookdale facilities, or sell the properties. Management expects $600 million to $900 million in total asset sales as a result of this restructuring. The good news is that these properties are expected to sell for cash yields of 6.5% to 7%, which is essentially the same yield that the REIT obtains for its new properties and development projects.

In other words, management is confident that any cash flow lost from these asset sales will eventually be recouped as HCP reinvests the proceeds.

Regardless, the takeaway is that HCP’s multiyear turnaround continues. The REIT’s ultimate goal is to eventually sell off any troubled assets and invest those proceeds into the three growth areas that HCP believes will thrive in today’s challenging healthcare environment: private payer senior housing, medical office buildings, and life sciences.

HCP’s entire $900 million three-year development pipeline is devoted to these areas, which represent a $600 billion potential growth market.

HCP already owns 27 million square feet of medical office buildings and life science properties, with its largest focus on San Francisco, San Diego, and Boston. HCP’s life science facilities have 97% occupancy and are leased to large, established institutions and companies such as:

- Amgen (AMGN)

- Merck (MRK)

- Alphabet (GOOG)

- Duke University

Life science properties are a great way to profit from the boom in biotech and pharmaceutical research. There are over 10,000 drugs in development at any one time, a figure that’s been growing about 5% a year for the last decade. As a result, the global R&D industry is about $275 billion a year in size and expected to grow 4% to 5% a year for the foreseeable future.

Meanwhile, medical office businesses are a solid industry for HCP to focus on as well for two main reasons. First, rising healthcare costs mean that both private and government insurance payers are desperate to drive down costs.

One of the easiest ways to do this to shift patient visits from costly inpatient care, to outpatient office visits. For example, the number of inpatient visit days declined by 0.7% per year between 1994 and 2014.

In contrast, outpatient visits grew 3% annually during that time. As importantly, the desire for cost savings means that medical office building tenants are increasingly looking to achieve economies of scale. This means becoming affiliated with major healthcare systems, such as those on university medical campuses.

HCP’s medical office buildings enjoy over 90% occupancy, 81% of them are located in major medical centers, and 94% are affiliated with major medical systems. Most are in large urban areas which gives HCP relatively high pricing power.

Medical office buildings are also an industry with meaningful switching costs. Doctors are usually unwilling (or sometimes blocked by regulations) from switching locations once a lease is up, for example. Doing so is usually very disruptive to one’s practice, especially if you’re affiliated with a particular medical system and all your patients are used to going to your current location.

The bottom line is that life sciences and medical office buildings are two of the healthiest and fastest growing parts of the healthcare system. With U.S. healthcare spending certain to rise significantly over the coming decades, HCP appears to be reducing risk in its portfolio and positioning itself well for profitable long-term growth.

However, prospective investors need to realize that HCP still faces numerous challenges before its turnaround plan can be deemed a success.

Key Risks

HCP lost its status as a dividend aristocrat in 2016 when it spun off QCP, which does not pay a dividend. The company’s new payout has since remained frozen for six quarters now.

The REIT’s lack of dividend growth is unfortunate but understandable. After all, QCP represented the most troubled SNF properties, whose cash flow/rent ratios were very close to one, indicating that ManorCare couldn’t afford to cover its rent and other operating expenses.

However, even with no exposure to the struggling skilled nursing facility industry, HCP still has numerous troubled tenants in senior housing, which accounts for roughly 40% of its cash flow.

As previously discussed, the biggest troubled tenant here is Brookdale, which even will provide about 16% of HCPs total rent even after the restructuring. The trouble is that Brookdale’s cash flow/rent coverage is just 1.09, despite the rent concessions that it was granted as part of its latest restructuring.

Senior housing tenants are considered relatively safe if they have rent coverage ratios of 1.2 or higher. Brookdale’s dangerously low coverage ratio indicates that it’s suffering more than most from the industry’s two major problems.

First, the expected demographic wave of aging baby boomers has long been anticipated and property developers have been aggressively overbuilding. This has resulted in a supply glut, falling occupancy, and declining margins for operators like Brookdale.

With the labor market the strongest it’s been in nearly 20 years, medical labor costs could accelerate in the coming years as well, meaning that senior housing operators are likely to face a challenging few years.

However, the bigger problem for HCP dividend investors is that the safety of the company’s payout appears to be declining. HCP has been selling assets far quicker than buying or developing new ones, which results in declining cash flow coverage of the dividend.

For example, in 2017 the REIT sold $1.6 billion in properties while buying $562 million in new ones. While the quality of the portfolio should be rising over time, dividends are paid out of cash flow. HCP’s net asset sales are hurting adjusted funds from operation, or AFFO (similar to free cash flow for REITs and needed to pay sustainable dividends).

Thanks to the restructuring, QCP spinoff, and asset sales, HCP’s AFFO per share declined 6% in 2016, 33% in 2017, and management now expects it to decline about 9% in 2018.

As a result, the REIT’s AFFO payout ratio is set to rise from 82% in 2016 (before the restructuring plan) to 93% in 2018. Analysts expressed some concern about the dividend’s coverage on HCP’s fourth-quarter earnings conference call.

Management’s defense of the payout’s safety was based on the strategic moves the company has made in recent years to create a much more stable stream of cash flow.

“One other thing that I would mention that I looked at is the quality of the portfolio as we look at a dividend coverage in the low 90s. Having sold the non-core assets that were not components of the portfolio that we wanted to hold long term, lot of those assets, we felt, had a lot of risk around them. Now that we’ve cleaned that portfolio up, we think we have a much, much more stable portfolio as far as the cash flow generation. So despite the fact that what you’re saying is true, I think it’s partially offset by same-store growth throughout the quarters and a very stable portfolio.”

– Tom Herzog, CEO of HCP

Usually medical REITs want to keep their payouts ratios at 80% to 85%, meaning that HCP investors are likely to see little or no dividend growth for several years.

Sluggish dividend growth is also likely because HCP is expecting challenges in its medical office buildings and life science markets, with the rate of cash flow growth to slow over the short term. Medical office buildings are now also starting to see a supply glut, reducing their some of their pricing power.

In addition, one of HCP’s key life science tenants (Rigel Pharmaceuticals) required a drastically reduced rent in order to avoid insolvency (biotech is a very high-risk industry). That’s largely why HCP is guiding for medical office buildings same-store net operating income growth to decline to 2.25% (from 3% in 2017), and life science same-store net operating income to rise just 0.75% (down from 4.2% in 2017). The Rigel rent concession accounts for 3% of that decline.

At the end of the day, HCP’s guidance and recent results show that the medical industry continues to experience a lot of disruption and challenges. Government policy shifts, rising labor costs, over capacity, and massive consolidation in healthcare insurance all suggest that medical REIT tenants could struggle far more than investors anticipated. At least until the aging population thesis takes hold in a more meaningful way.

Closing Thoughts on HCP

It’s been a very disappointing few years for HCP investors. What was once a venerable dividend aristocrat ended up sharply reducing and then freezing its payout for the foreseeable future.

While management’s underlying long-term restructuring plan appears sound, the fact remains that the entire medical REIT industry is struggling to adapt to changing industry conditions. Rising healthcare demand can clearly be a curse, as well as a blessing, because it can result in rapid and sweeping overhauls and industry supply and demand imbalances.

HCP’s current dividend is likely to remain safe for now, but the fact remains that the company is smaller, less well capitalized, and has a weaker balance sheet than rivals such as Welltower and Ventas. Income investors interested in healthcare REITs may consider those alternatives instead, which offer some dividend growth in addition to their high yields.

To learn more about HCP’s dividend safety and growth profile, please click here.

Leave A Comment