Cracker Barrel Old Country Store (CBRL) has been in business since 1969 and operates a chain of more than 650 restaurants located throughout the U.S. The company’s country-themed, full-service restaurant served 7,000 guests per week in 2017, offering diners a variety of breakfast (24% of sales), lunch (39%), and dinner (37%) foods with meals costing about $10 on average.

Each restaurant location also has a large gift shop, which offers over 4,500 decorative and functional items, such as apparel and accessories (30% of retail sales), packaged foods (18%), decor (13%), toys (11%), and bed and bath goods (8%).

In 2017, about 80% of Cracker Barrel’s revenue was generated from restaurants, with the remaining 20% from its gift shops.

In 2016, Cracker Barrel also launched its new fast casual concept, Holler & Dash Biscuit House. These are smaller format restaurants offering biscuit-inspired meals and a portfolio of alcoholic and non-alcoholic beverage options. The company currently has six Holler & Dash restaurants and plans to open three to four more in 2018 along with eight or nine Cracker Barrel stores.

Business Analysis

The restaurant industry is extremely challenging thanks to brutal competition, (there are over 600,000 restaurants in the U.S.), a business model that’s very sensitive to the economy, high labor turnover rates, and fluctuating input costs that can result in wild swings in earnings.

In fact, approximately 59% of restaurants fail or change ownership within their first three years, according to a study conducted by Cornell University.

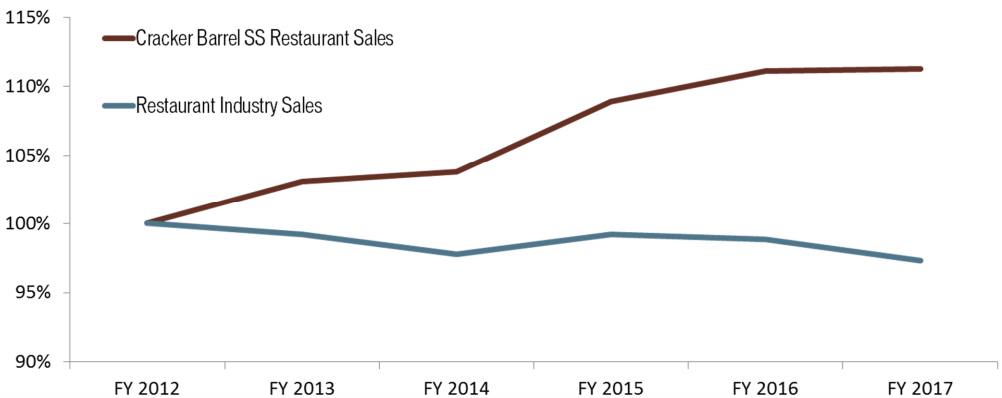

However, Cracker Barrel has done better than most of its peers at managing to maintain both top and bottom line growth. As you can see below, the company’s same-store restaurant sales, which measures sales growth from locations open at least a year, have far outpaced the restaurant industry’s sales over the last six years.

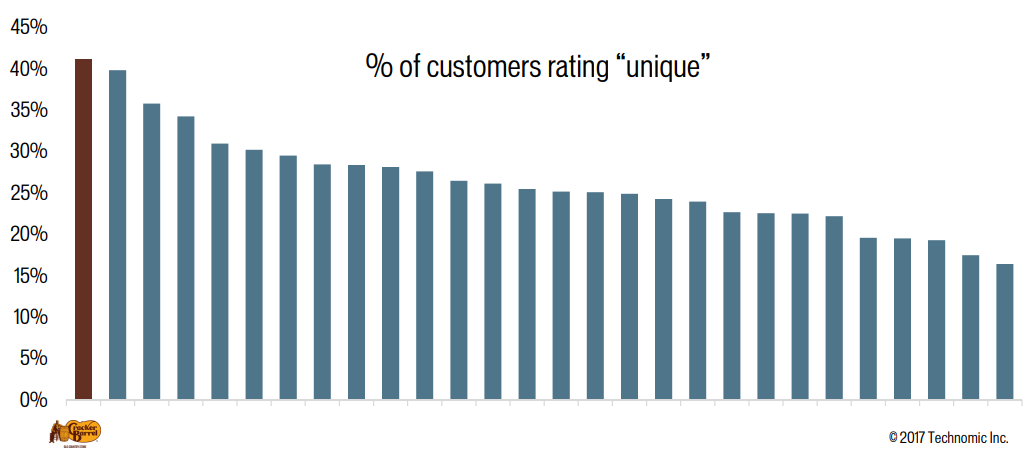

Cracker Barrel’s impressive outperformance is likely due to its differentiated restaurant concept, which had the highest proportion of its customers rating it as “unique” according to Technomic. Simply put, the company has done a great job mastering the Southern casual dining experience.

Management plans to reinforce Cracker Barrel’s successful positioning over the coming years with several long-term strategies.

First, the company wants to enhance its core brand with new menu items to continue meeting consumers’ tastes. Cracker Barrel is frequently experimenting with new seasonal and limited time offerings including entrées like a French Dip Sandwich Platter, Mushroom Braised Pot Roast, and Peppermill Steak and Eggs Breakfast that it introduced in 2017.

The company also launched a holiday Heat ‘n Serve program, in which customers pick up pre-prepared food and heat it up in their ovens at home. It plans to expand its off-premise business in the future from 7% of sales today to at least 10%.

Meanwhile, Cracker Barrel is also trying to reduce store operating costs via initiatives that target labor productivity, food waste, and utility expenses. In 2017, the company managed to cut annual operating costs by over $20 million.

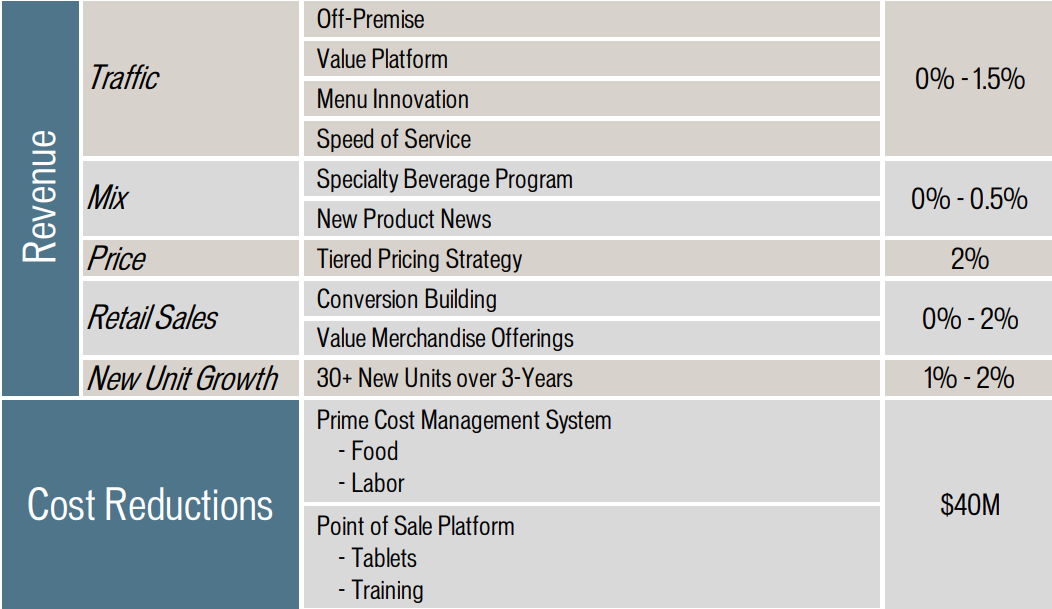

Management thinks its can cut an additional $40 million per year (1.4% of sales) in costs over the next three years. The company is also experimenting with mobile payments to try to make it more convenient to pay, and hopefully increase throughput at its restaurants.

Cracker Barrel’s advertising spending, which came in at 2.9% of revenue in 2017, is highly focused on achieving maximum impact by leveraging 1,600 billboards (83% of is locations are located on highways), limited TV ad campaigns, and social media. Spending is largely targeted at Millenials, who are willing to spend far more on eating out than other generations, according to a survey from Bankrate.com.

In fact, 54% of Millenials eat out at least three times per week, and that number climbs to an average of five times per week if you include stopping at coffee shops such as Starbucks (SBUX). In comparison, only 40% of non-Millenials eat out frequently, which is defined as once or more per week.

Cracker Barrel’s second growth strategy is to expand its store count. In 2017, Cracker Barrel opened six stores, and the company plans on opening eight to nine more stores in 2018. That’s part of a broader plan to increase the store count by 30 locations between 2018 and 2020, with an ultimately long-term goal of operating 750 to 800 units (compared to around 650 today).

As the Cracker Barrel concept continues maturing, the company wants to expand its brand with new concepts including the Holler & Dash Biscuit House concept it launched in 2016.

Holler & Dash Biscuit House is mostly a regional concept for now, focused on the Southeast. The company plans to open three to four new locations in 2018, but this business will likely remain a relatively small portion of the firm’s overall earnings for now. Cracker Barrel is also considering other new restaurant concepts, but the would be similar to its core “old fashioned down home cooking” theme.

Besides more brick-and-mortar locations, the company plans to invest in expanding its e-commerce platform to drive more online sales at its retail stores. Fortunately, Cracker Barrel has a relatively strong balance sheet to invest in such efforts.

For example, the company has an adjusted net debt / EBITDA ratio of 1.8, which is very healthy and shows that Cracker Barrel’s debt load is well covered by cash flow. The business also has $760 million in untapped revolving credit facilities and roughly $170 million in cash on hand, meaning that it has over $900 million in liquidity to expand and invest in its online sales channels and new restaurant locaitons.

Cracker Barrel has done an admirable job of running its business conservatively and navigating the challenging waters of the casual dining industry. Despite a lack of scale compared to some larger restaurant peers, Cracker Barrel’s profitability is far above average.

For example, the company’s operating and net margins are 9.7% and 6.9%, compared to industry averages of 5.1% and 2.8%, respectively. And more importantly, Cracker Barrel’s business model generates excellent free cash flow for a restaurant, which has allowed it to be very generous with returning cash to shareholders.

Cracker Barrel has paid uninterrupted dividends for more than 15 years while also issuing large and growing annual special dividends.

While special dividends are nice, they shouldn’t be counted on for steady income. That’s why it’s important to focus on the regular dividend, which currently consumes about 55% of the company’s free cash flow. This is a reasonably safe payout ratio but one that likely can’t rise much higher if Cracker Barrel wants to preserve a good safety margin for its dividend.

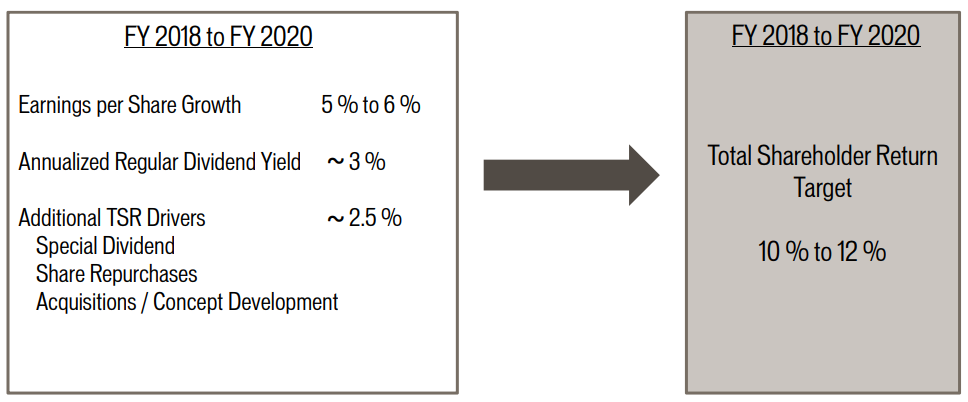

In other words, investors can’t expect the company’s double-digit average annual dividend growth rate to continue. Going forward, Cracker Barrel is likely to grow the dividend in line with earnings and cash flow, which are expected to continue expanding at a mid-single-digit pace in the years ahead based on management’s three-year plan.

The bulk of growth is expected to come from higher prices, new store openings, retail-related sales improvements, and cost reductions.

Overall, Cracker Barrel has done a great job differentiating itself in a very crowded and competitive marketplace. The company’s unique Southern brand, economies of scale, relatively low-cost locations off highways, conservative balance sheet, and blend of restaurant and gift shop revenue have helped it create meaningful value for dividend growth investors over the years.

Key Risks

Cracker Barrel expects the environment to be challenging going forward. From increased pressure on brick-and-mortar retail (gift shops account for 20% of company-wide revenue), to restaurant discounting, commodity price inflation, and labor market shortages, a number of risk factors could throw off the company’s long-term plans.

Cracker Barrel benefitted from relatively strong same-store sales growth and flat labor and food prices for several years, but these drivers have started to reverse. Cracker Barrel snapped an 11 quarter streak of positive same-store sales growth at its restaurants in early 2017, and its retail sales have been falling steadily for several years.

Overall, Cracker Barrel’s same-store restaurant sales edged higher by 0.2% and its same-store retail sales slumped 3.7% in fiscal 2017. The good news is that management has made some progress turning these trends around.

For fiscal 2018, management expects about 1.5% restaurant comps growth, flat retail growth, and food inflation of 2.5% to 3%. Rising food inflation could be a problem for Cracker Barrel in the next few years because food costs and labor consume about 65% of its total revenue.

In the past two years, falling food prices and flat labor costs (stores not located in many states raising minimum wage) have helped Cracker Barrel keep most of the price increases it was able to command from consumers.

However, if food prices start rising at 2% to 3% a year, then that will more than offset the likely price increases that Cracker Barrel will be able to pass onto customers. Meanwhile, labor costs are likely to rise given that the labor market is now the tightest it has been in nearly 20 years.

Or to put it another way, the combination of rising food prices and wage costs could end up eating into Cracker Barrel’s margins. And given that the restaurant is still struggling to grow its foot traffic, there is little chance that it can hike prices faster without further hurting its same-store sales.

Those sales are particularly important to Cracker Barrel’s retail stores, since so far very little of its retail sales are coming from online channels. Ultimately this is a big reason to feel less enthusiastic about Cracker Barrel, because the company’s main niche is that it’s a general store and a restaurant.

However, several years of declining retail sales have shown that its nostalgic retail niche is not competing well in the age e-commerce. Rather than serving as a nice growth booster to what is apparently a pretty popular restaurant concept, Cracker Barrel’s gift shops have proven to be more of an albatross because they sell the wrong product mix for today’s consumer tastes.

While management says it plans to increase the company’s online sales in the future, so far it’s given no specifics on how it plans to do that in a cost effective manner that’s likely to be successful.

In the meantime, Cracker Barrel is facing short-term margin compression and has little growth prospects other than opening new stores and concepts. Given the slow pace of new store growth (about 2% per year), the company might be facing flat revenue and earnings growth for the next few years.

Investors need to ask the question of how many Cracker Barrel locations can really be opened and maintained profitably. As a casual sit-down restaurant, and one with a very specific regional theme, the total addressable market may not be much larger than the company’s store count currently serves.

Closing Thoughts on Cracker Barrel Old Country Store

The restaurant business is very competitive, cyclical, and not where one usually looks for steadily growing dividends. Cracker Barrel has managed to handle the industry’s numerous challenges well, recording superior same-store restaurant sales, relatively fast earnings growth, and generous dividend increases over the last five years.

However, given the cyclical nature of the industry and the maturity of Cracker Barrel’s core concept, the company is likely to grow its top and bottom line much slower going forward. When combined with the struggles the firm is having with its retail business in an ever-more digital world, Cracker Barrel’s best dividend growth days could be behind it.

The company’s dividend certainly appears to remain on solid ground, but income investors looking at Cracker Barrel may be able to find a better combination of income and growth elsewhere, especially in other industries that are less ruthless than the restaurant business.

To learn more about Cracker Barrel’s dividend safety and growth profile, please click here.

Leave A Comment