Founded in 1985, Blackstone Group L.P. (BX) is the world’s largest alternative asset manager with about 2,400 employees and $450 billion in assets under management. The firm specializes in private equity (direct ownership of private companies), real estate, hedge funds, and investing in private debt.

Blackstone earns its money by charging investors a base management fee (about 0.8%) plus performance fees (a percentage of profits above a certain hurdle rate) which can be extremely lucrative. In the past 12 months, 43% of the company’s revenue was in the form of base management fees, while 54% was from performance fees. The remaining 3% was from net realized gains on investments.

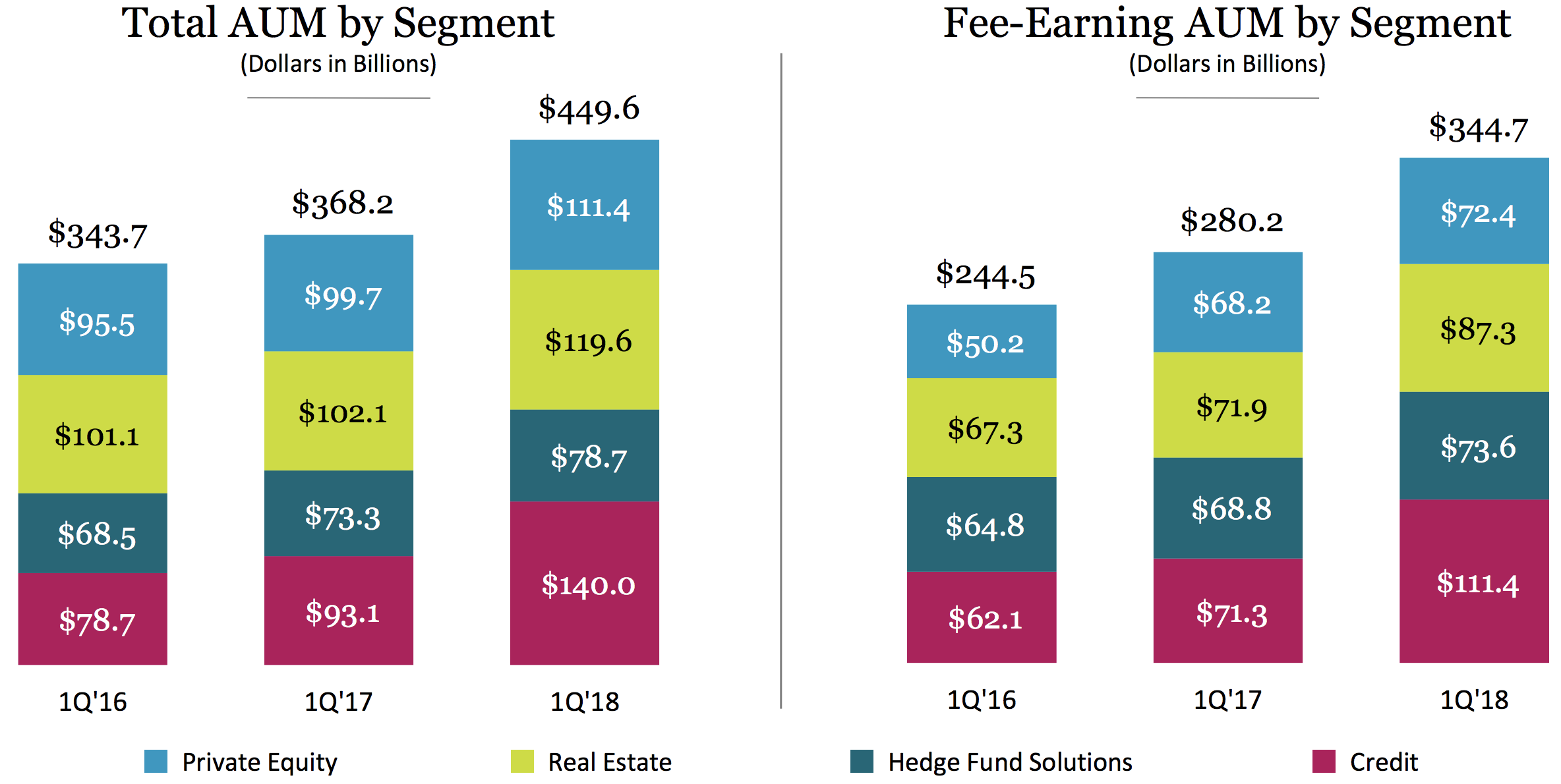

Here’s a look at Blackstone’s business mix:

- Real Estate: 38% of revenue, 44% of operating income

- Private Equity: 41% of revenue, 42% of operating income

- Credit: 12% of revenue, 10% of operating income

- Hedge Funds: 8% of revenue, 7% of operating income

The vast majority of the firm’s revenue and operating profits come from its real estate and private equity divisions, which have historically been where Blackstone’s expertise lies.

In contrast, hedge fund solutions and private debt investing are newer units in which the firm is still working on developing the right expertise needed to give it an edge over its peers. For example, hedge fund solutions (Blackstone Alternative Asset Management) is a discretionary allocator of capital to other hedge funds. Blackstone is essentially helping to seed and increase fund flows to third party run funds rather than operate its own potentially lucrative ones.

Meanwhile, the credit business consists of GSO Capital Partners LP, which Blackstone acquired in 2008. This business mostly invests in non-investment grade debt (junk bonds), with a goal of buying deeply discounted bonds that will appreciate in value if the company that issued them is able to remain in business and not default on its debt.

Business Analysis

Unlike actively managed mutual funds which have been suffering from the increasing popularity of passive index investing, alternative asset management is a thriving business. In fact, over the past several years the industry’s assets under management (AUM) have been growing at about 9% annually, and analyst firm PricewaterhouseCoopers estimates that by 2020 the industry’s AUM will hit $14 trillion.

Alternative assets are very popular with institutional money managers such as pension funds, sovereign wealth funds, and private endowments (e.g. colleges and charities). Their appeal is driven by their potential to provide a combination of strong long-term returns that are less correlated to broader asset classes like stocks and bonds.

In other words, alternative assets are usually a far less liquid (some funds have lock-up periods of 10 to 15 years) form of investment but can also offer superior risk-adjusted total returns (the key idea behind hedge funds for example).

In order to do well in alternative assets, a management company needs to have a proven track record of above-average performance over time, which builds its reputation and attracts fresh inflows of investor capital. Another key competitive advantage is a wide global distribution network. This not only allows the sourcing of client funds from all over the world but is key to having insider knowledge of key markets (such a venture capital, private real estate, and private equity) to earn outsized returns.

Over the past five, 10 and 15 years Blackstone’s average fund has earned about 15% annual total returns net of expenses. This is among the best performance in the industry and a key reason the company enjoys its dominant position today.

Blackstone’s edge historically lies in real estate and private equity. This is thanks to the firm’s substantial experience in structuring such deals. For example. Blackstone pays top dollar to retain top private equity talent that is skilled at buying undervalued private companies opportunistically in order to create value by increasing their operational efficiency, growing them (organically and through M&A), and later selling them at a profit or having them go public.

The firm’s real estate business is staffed with seasoned industry veterans from all over the world who are experts in regional markets in North America, Europe, Asia and Latin America. Their deep industry connections mean Blackstone is able to obtain large volumes of lucrative deal flow. Much of this is from unlisted private real estate transactions that usually have higher profitability than publicly listed real estate transactions.

Thanks to its talented managers (and very strong price appreciation across most asset classes), in 2017 Blackstone’s funds generated 8% to 23% total returns net of expenses. The hedge fund business was the lowest performer with 8% net total returns but managed to achieve that decent performance with less than a third of the S&P 500’s volatility. Hedge funds are mostly owned for their risk-adjusted returns (total net return/volatility) which means that Blackstone’s hedge fund clients were likely happy with these results.

The company’s large size, global reach, and quality reputation mean that it also enjoys some of the best liquidity in the industry. When Blackstone sees an investable opportunity, it can afford to go after it (the firm had over $90 billion in dry powder in early 2018). Smaller money managers are unable to pursue the largest and potentially most lucrative deals since they lack sufficient investable capital.

For example, in 2007 Blackstone put together two of the largest private equity acquisitions in history, acquiring Hilton and Equity Office Properties for $27 billion and $39 billion, respectively. The Hilton acquisition was funded 80% with debt, meaning that Blackstone put up just $5.6 billion in equity (cash) and was able to leverage this investment at a five to one ration. The Equity Office acquisition was later sold off in chunks at a roughly 200% total return.

Beyond its unique ability to make massive deals, the company also gains competitive advantages from its strong brand and innovation. Close to half of Blackstone’s total assets under management come from products and business that were not part of its mix just a few years ago.

Launching new offerings is easier for Blackstone because of its established reputation, distribution relationships with major investors, and economies of scale.

Due to a combination of rising global asset prices across its expanding business lines and the firm’s better than average asset management skill, Blackstone’s performance fees have been rising steadily over the past few years.

And thanks to its industry-leading economies of scale and capital-light business model, Blackstone enjoys very strong profitability. The firm’s operating margin is north of 40%, and Blackstone’s return on invested capital sits near 25%.

These measures are significantly ahead of the firm’s peers, which is a sign of good capital allocation by management and explains why Blackstone has an edge in attracting and retaining client funds.

For example, in the first quarter of 2018 the company saw $8.4 billion in net inflows, or a 3% increase over last year. In 2017, Blackstone enjoyed record inflows of $108 billion which boosted its AUM by 30%, partially due to extremely strong fund performance (real estate and private equity markets were booming last year).

Historically, Blackstone’s net inflows have been growing between 3% and 5% annually in recent years. This builds up the firm’s asset base, increasing base management fees and potentially setting up much greater performance fees in the future.

The company also benefits from a strong balance sheet which gives it financial flexibility to grow into new markets and different types of investments. While Blackstone has a large amount of debt in absolute terms, in reality it has a net cash position when factoring in cash on the balance sheet and accrued performance fees.

Combined with its relatively conservative debt ratios, Blackstone enjoys an A+ credit rating from Standard & Poor’s. That’s the highest rating of any alternative asset manager, helping Blackstone enjoy very low borrowing costs.

The firm’s large size and strong balance sheet have allowed it to grow through acquisitions of other asset managers and financial companies. The alternative asset management industry is driven by relationships and reputation, so oftentimes the easiest way to break into a new business line or market is to acquire a full or partial stake in an already established firm.

Since 2009 Blackstone has been very aggressive in diversifying into new investment strategies, whose AUM has grown five times faster than its legacy existing businesses. At the end of 2017, about 60% of the company’s assets were invested in faster growing new strategies, such as infrastructure investment.

Another big growth opportunity is in private wealth management (especially for ultra-high net worth individuals). Blackstone’s new private wealth solutions division is attempting to become a one-stop shop for the ultra wealthy, capable of handling all of their financial needs all over the world. That includes insurance, which is a $23 trillion global business and is Blackstone’s newest product platform.

Over the next few years, analysts expect that a strong global economy should allow Blackstone to grow its earnings by about 10% annually. However, even if the company manages to achieve that growth estimate (far from certain) it may not end up benefiting income investors very much.

That’s because there are key risks and negative aspects to Blackstone’s business model that make it an imperfect investment for investors seeking predictable income.

Key Risks

Most notably, the asset management industry is highly cyclical, since base management and performance fees are tied to AUM, fickle capital gains, and investor sentiment. Blackstone’s private equity business is also variable since the profits it can make often depend on the stock market’s health (a key exit strategy is to take privately owned firms public, monetizing some of its ownership stake).

Blackstone has benefited from nearly a decade of strong U.S. and economic growth. Importantly, record low interest rates around the world sent asset prices of all kinds, especially real estate and company valuations, soaring. This has allowed Blackstone to enjoy boom times in its top and bottom lines. But during the next recession (and bear market), the company’s revenue and earnings could be severely impacted.

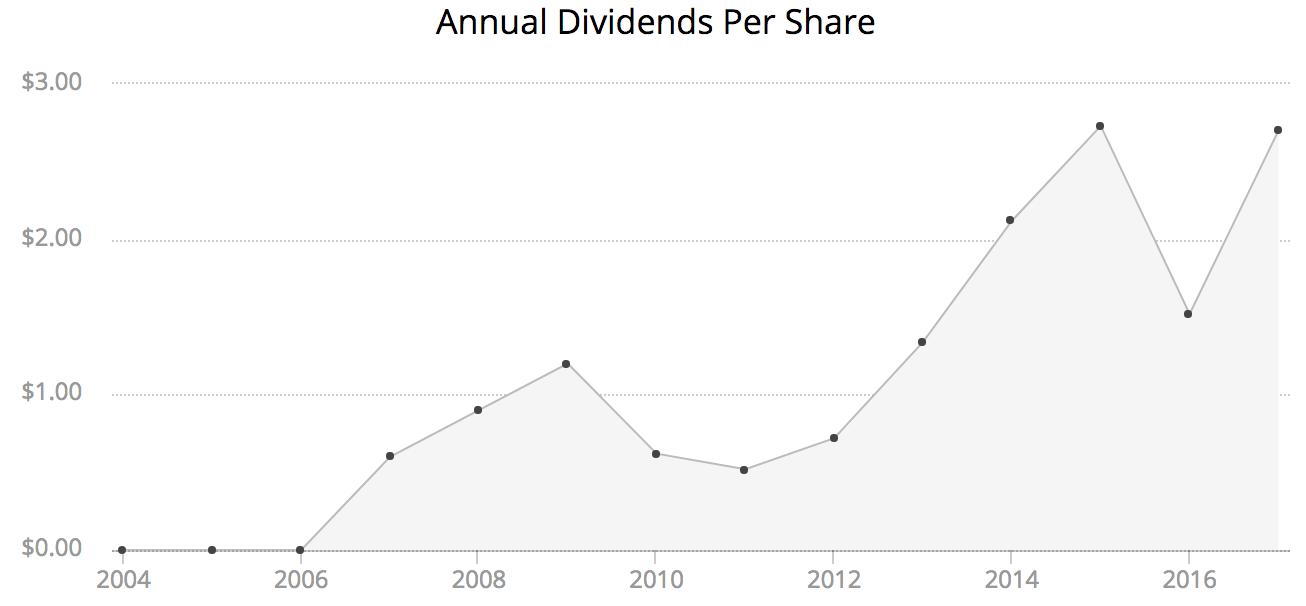

When combined with the unpredictable nature of the capital gains Blackstone generates when it sells some of its private equity holdings, the firm has a variable dividend that fluctuates wildly over time.

Therefore, despite its generous payout, Blackstone may be unsuitable for anyone seeking steady and growing dividends from year to year. The stock is also harder to value in terms of its current yield relative to its long-term average yield over time.

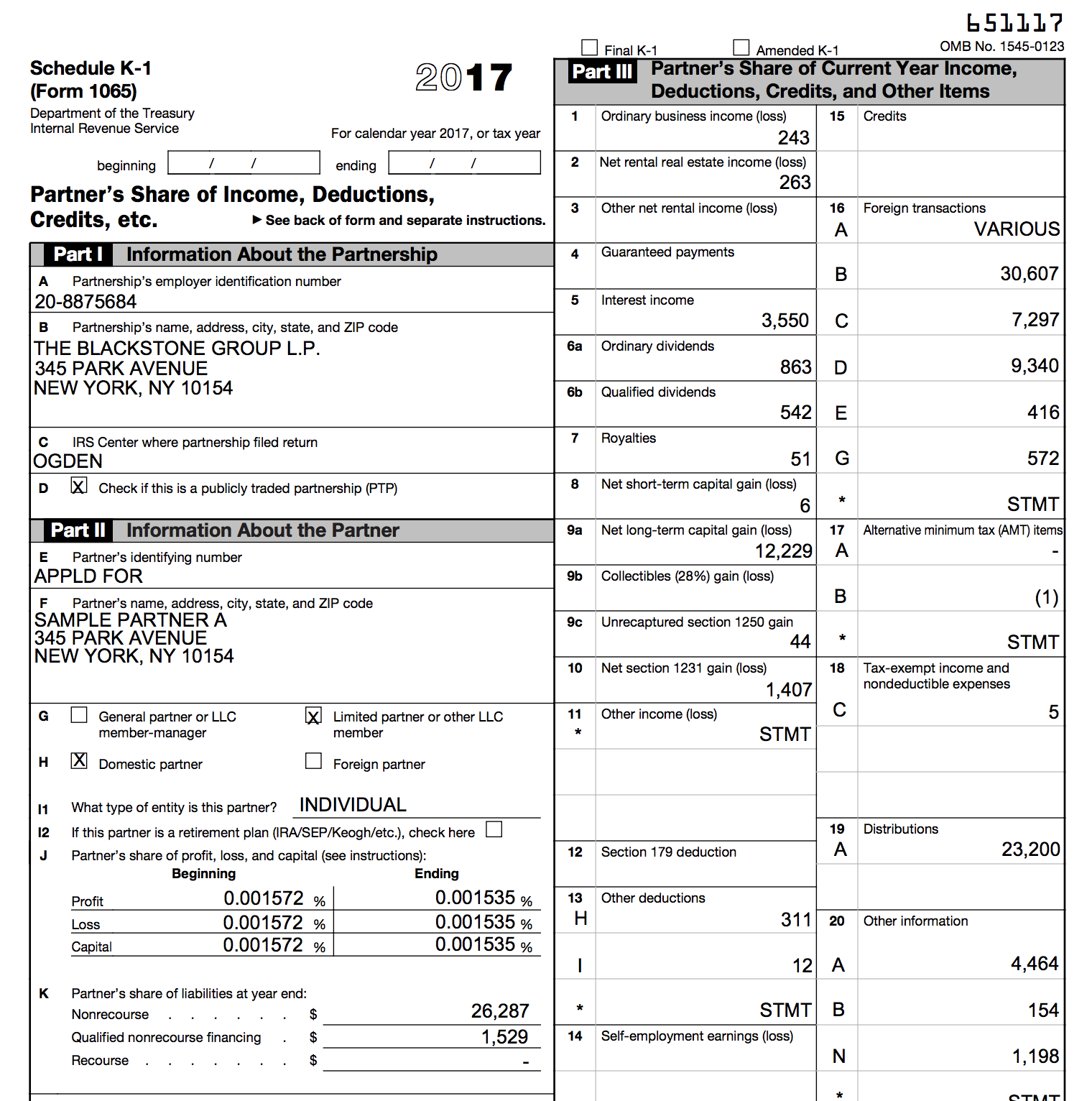

Then there’s the issue of how Blackstone is structured. Blackstone is technically a limited partnership which means it issues a K-1 form. This creates far more complexity at tax time.

Specifically, the firms distributions are a complex mix of ordinary income, returns of capital (lowers your cost basis), and other types of income (such as UBTI). As a result, Blackstone is best held in a taxable account because some of these income types can create headaches if owned in an IRA or 401(k).

In addition to complex taxes, Blackstone’s LP status means that it frequently raises growth capital via dilutionary equity offerings. Over the last eight years the LP’s distribution count has increased by 12.2% annually. This creates more growth headwind in terms of EPS and long-term dividend growth since management has to ensure that any equity capital it raises will more than offset the extra share count over time. If it can’t, then dividend volatility will only increase in the future.

Closing Thoughts on Blackstone Group L.P.

The alternative asset industry is enormous, growing quickly, and incredibly lucrative (when times are good). Blackstone, as the industry’s dominant player, represents a potentially solid way for regular investors to gain exposure to investment types and asset classes that are normally out of their reach. This includes: venture capital, private equity, hedge funds, and private real estate.

That being said, while Blackstone is among the best-run firms in its industry, the company’s complex business model is still prone to wild swings in revenue and earnings. The end result is highly variable dividends that make Blackstone more suitable for risk tolerant investors who don’t mind income fluctuations from one quarter to the next.

In addition, don’t forget that as a limited partnership, Blackstone’s generous (for now) distributions come with the added tax complexity of a K-1 form that makes this an unsuitable investment for retirement accounts.

great article Brian.

There are tax issues in an IRA but they relate mainly to the UBTI as you mention. IRS allows $1000 of UBTI before forcing IRAs to pay taxes on it ( payment of the tax requires a distribution). The k-1 you illustrate is a sample for 10000 shares far higher than most of your readers I suspect will invest. UBTI is listed on line 20 V on the full k-1 and can be hard to figure out. The brokerages are now forcing IRAs to file 990t and charging the account a large sum of money to do so. So you are correct this is a headache and overly complex.